COMEX Gold - the Immediate Support Was Tested

rhboskres

Publish date: Wed, 11 Mar 2020, 05:39 PM

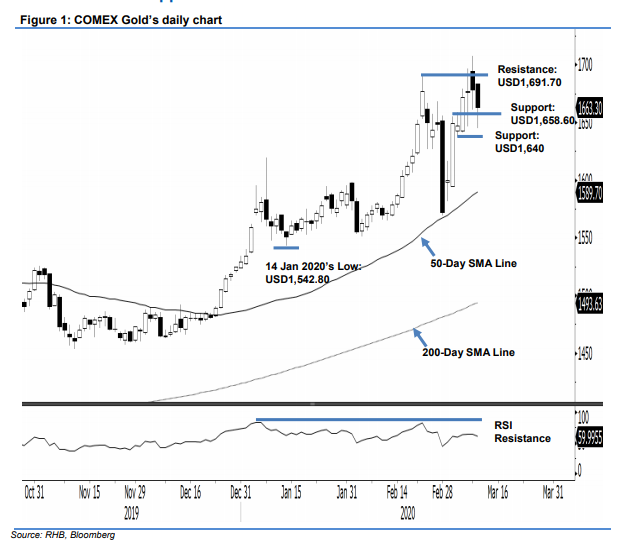

Maintain long positions, as there was no confirmation of a price rejection. The COMEX Gold slid by USD15.30 to close at USD1,663.30. This was after testing the USD1,658.60 immediate support with an intraday low of USD1,644.50. The weak session came after the precious metal failed in its two prior sessions’ attempts to close above the USD1,691.70 immediate resistance point. As mentioned in our previous report, to confirm a possible price rejection from said immediate resistance level, the commodity has to breach below the USD1,640 support threshold. We maintain our positive trading bias.

In the absence of a price reversal signal confirmation, we recommend traders stay in long positions. These were initiated at USD1,648.90, or the closing level of 3 Mar. For risk-management purposes, a stop-loss can be placed below the USD1,640 mark.

The immediate support is maintained at USD1,658.60, which was derived from 4 Mar’s candle. This is followed by USD1,640, or 5 Mar’s price point. Towards the upside, the immediate resistance is set at USD1,691.70, ie 24 Feb’s high, and followed by the USD1,700 round figure.

Source: RHB Securities Research - 11 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024