WTI Crude Futures - Rebound May Still Carry on

rhboskres

Publish date: Thu, 12 Mar 2020, 04:48 PM

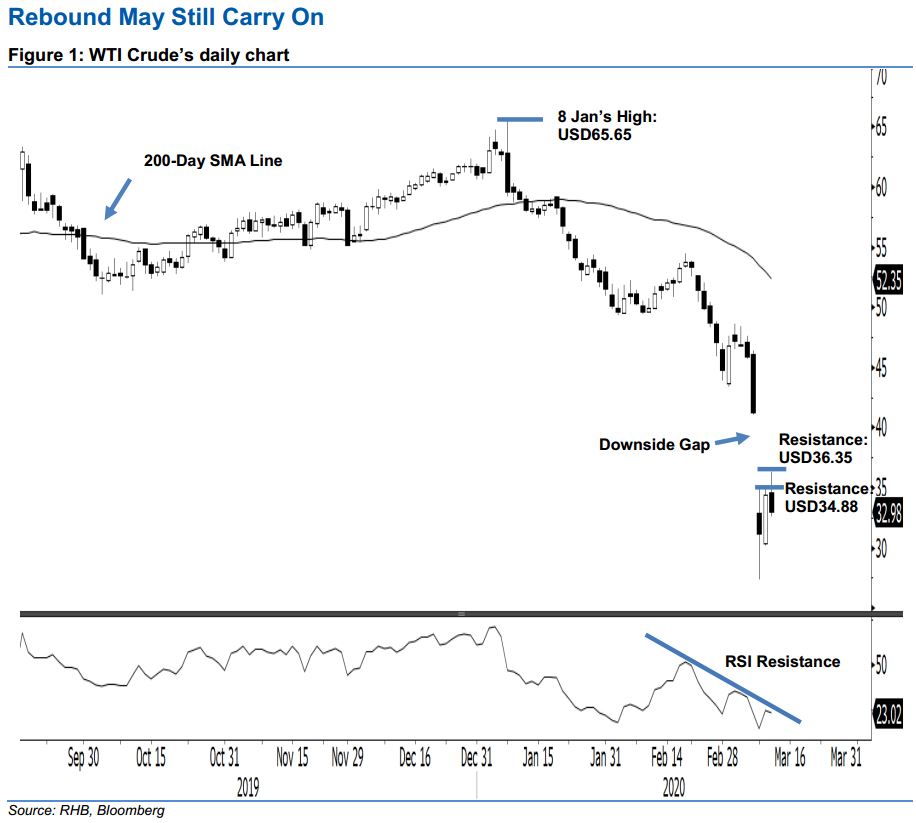

Maintain long positions as the counter-trend rebound may still be extending. The WTI Crude ended the latest session USD1.38 lower at USD32.98 – this was after it reached a session high of USD36.35. The high also means the USD34.88 resistance point was briefly tested. While the trading range is still wide and volatile, we believe the counter-trend may still have the potential to carry on to correct its sharp declines on 7 and 9 Mar. This is also supported by the RSI reading which is still flashing out an oversold signal. Maintain our positive trading bias.

As we have to see that the rebound has reached its top, we recommend traders to stay in long positions. These were initiated at USD34.36, the closing level of 10 Mar. To manage the risk, a stop-loss can be placed below the USD31.50 mark.

We maintain the immediate support level at USD32.70, followed by USD31.50 – both were derived from 10 Mar’s candle. Moving up, the immediate resistance is pegged at USD34.88, or the high of 9 Mar. This is followed by USD36.35, the latest high.

Source: RHB Securities Research - 12 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024