COMEX Gold - Tightening Up Trailing-Stop

rhboskres

Publish date: Thu, 12 Mar 2020, 04:51 PM

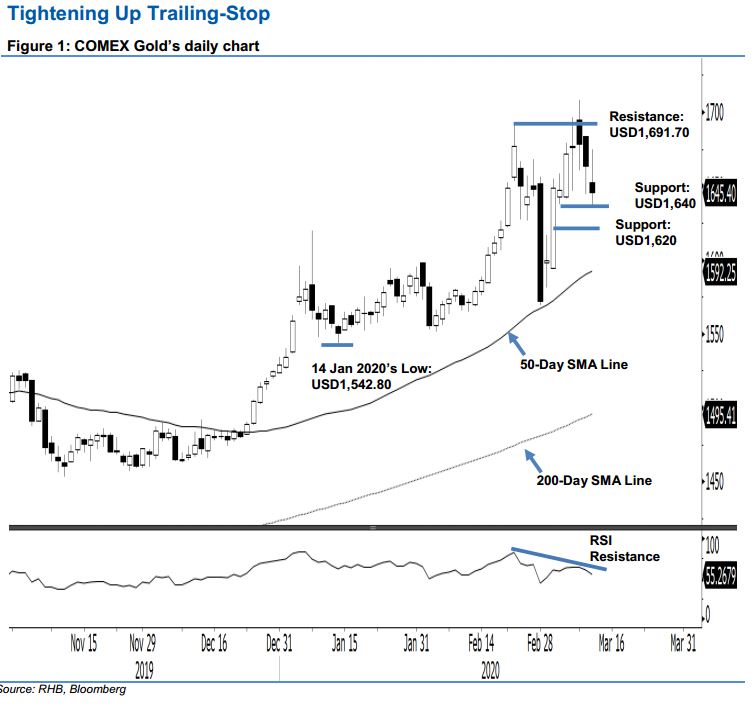

Important level was briefly tested, maintain long positions. The COMEX Gold retraced for the second consecutive session, easing USD17.90 to settle at USD1,645.40 – after testing the support level of USD1,640 with an intraday low of USD1,635.70. As highlighted in our recent notes, the precious metal has been showing signs of experiencing a price rejection from the USD1,691.70 level – after two failed attempts to close above this level. Towards the downside, a daily close below the USD1,640 mark would confirm such a possibility. For now, maintain our positive trading bias.

As the price reversal signal has yet to be confirmed, we recommend traders stay in long positions. These were initiated at USD1,648.90, or the closing level of 3 Mar. For risk-management purposes, a stop-loss can be placed below the USD1,640 mark.

The immediate support is revised to USD1,640, or 5 Mar’s price point. This is followed by USD1,620. Moving up, the immediate resistance is revised to USD1,674.70, the latest high. This is followed by USD1,691.70, ie 24 Feb’s high.

Source: RHB Securities Research - 12 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024