WTI Crude Futures : Rebound Phase Is Invalidated

rhboskres

Publish date: Fri, 13 Mar 2020, 09:28 AM

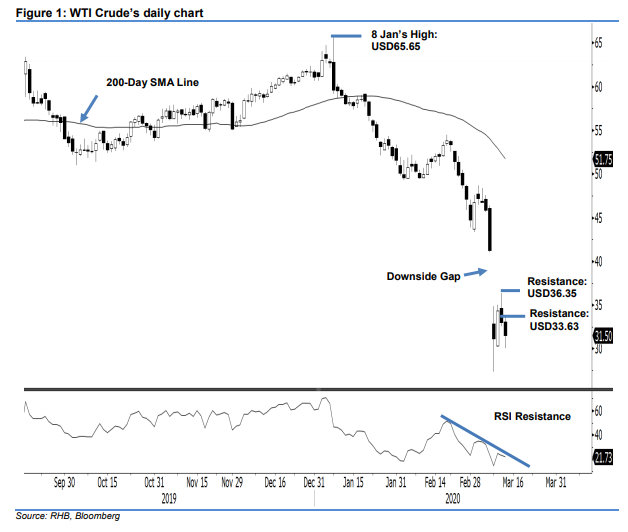

The counter trend may have ended – initiate short positions. The WTI Crude formed second consecutive black candle during the latest session. Consequently, this signals that its counter-trend rebound after the sharp declines of 7 and 9 Mar may have reached an end – and the risk of the weak trend resuming is high. The session’s trading range was wide – between USD30.03 and USD33.63 – before closing at USD31.50, which indicated a decline of USD1.48. Hence, we now switch our trading bias to negative.

Our previous long positions – initiated at USD34.36, or the closing level of 10 Mar – were closed out at USD31.50. On the bias that the retracement leg is resuming, we initiate short positions at the latest close. To manage the risk, a stop-loss can be placed above the USD36.35 threshold.

We revise the immediate support to USD29.44, which is followed by the USD27.34 level – both were derived from 9 Mar’s candle. Moving up, immediate resistance is set at USD33.63, or the latest high. This is followed by USD36.35, which was the high of 11 Mar.

Source: RHB Securities Research - 13 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024