FCPO: Bears Are Back

rhboskres

Publish date: Fri, 13 Mar 2020, 09:31 AM

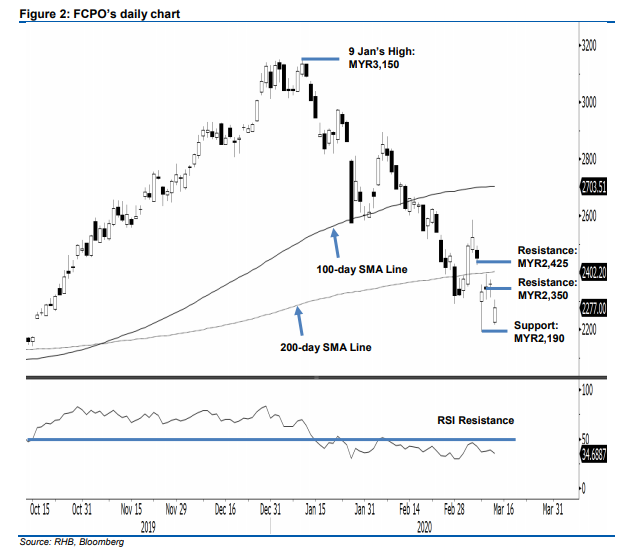

Maintain short positions as the risk of a further decline is still high. The FCPO closed the latest session MYR82 lower at MYR2,277, after it hit a low and high of MYR2,216 and MYR2,304. The weak session marked the end of the prior two sessions’ rebound, when the commodity tried to recoup the 200-day SMA line. We maintain that, as long as prices are still capped at under the said SMA, the risk of a further retracement remains high. As such, we make no change to our negative trading bias.

With the bears likely re-asserting control, we still recommend that traders stick to short positions. These were initiated at MYR2,332, or the close of 9 Mar. To manage risks, a stop-loss can be placed above the MYR2,425 threshold.

The immediate support is still pegged at MYR2,249, and followed by MYR2,190 – both derived from 9 Mar’s candle. Towards the upside, the immediate resistance is now at MYR2,350, the price point of 11 Mar. This is followed by MYR2,425, the low of 6 Mar.

Source: RHB Securities Research - 13 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024