FKLI - Briefly Tests 1,300-pt Level

rhboskres

Publish date: Mon, 16 Mar 2020, 10:44 AM

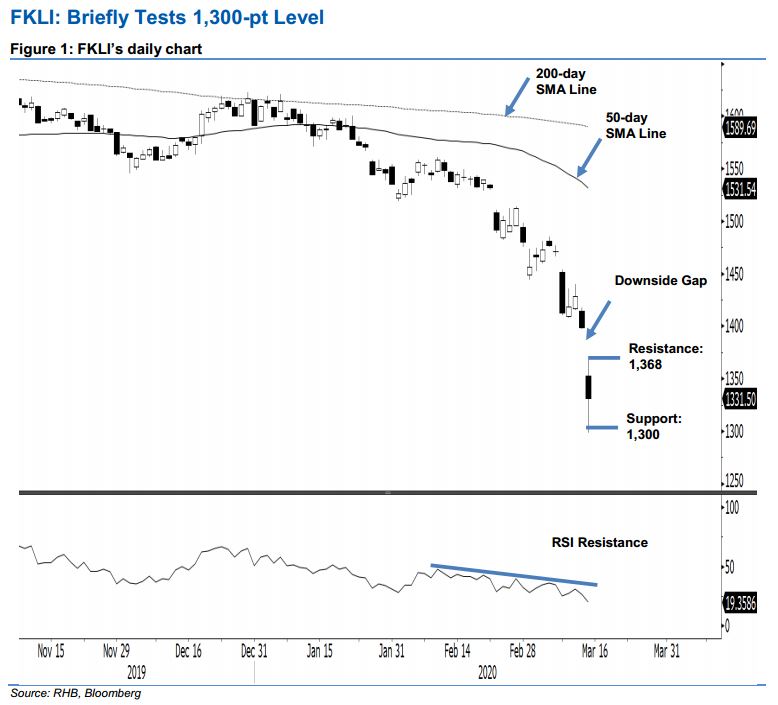

Maintain short positions as the bears are pushing ahead. The FKLI declined sharply last Friday. It charted a “Downside Gap” and reached a low of 1,298.5 pts, before narrowing losses to close at 1,331.5 pts – suggesting a decline of 67 pts. Even though it narrowed losses after briefly tested the 1,300-pt support mark, on the back of an extremely oversold RSI reading, there is no indication suggesting that the retracement has ended. As such, we maintain our negative trading bias.

As the bears still have firm control over the price trend, traders should remain in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can now be placed above the 1,368-pt mark.

The immediate support is pegged at 1,320 pts, derived from the latest candle, followed by 1,300-pt round figure. Moving up, the immediate resistance is pegged at 1,350-pt level, followed by 1,368 pts – both are latest sessions’ price points.

Source: RHB Securities Research - 16 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024