COMEX Gold - Another Steep Decline

rhboskres

Publish date: Mon, 16 Mar 2020, 10:55 AM

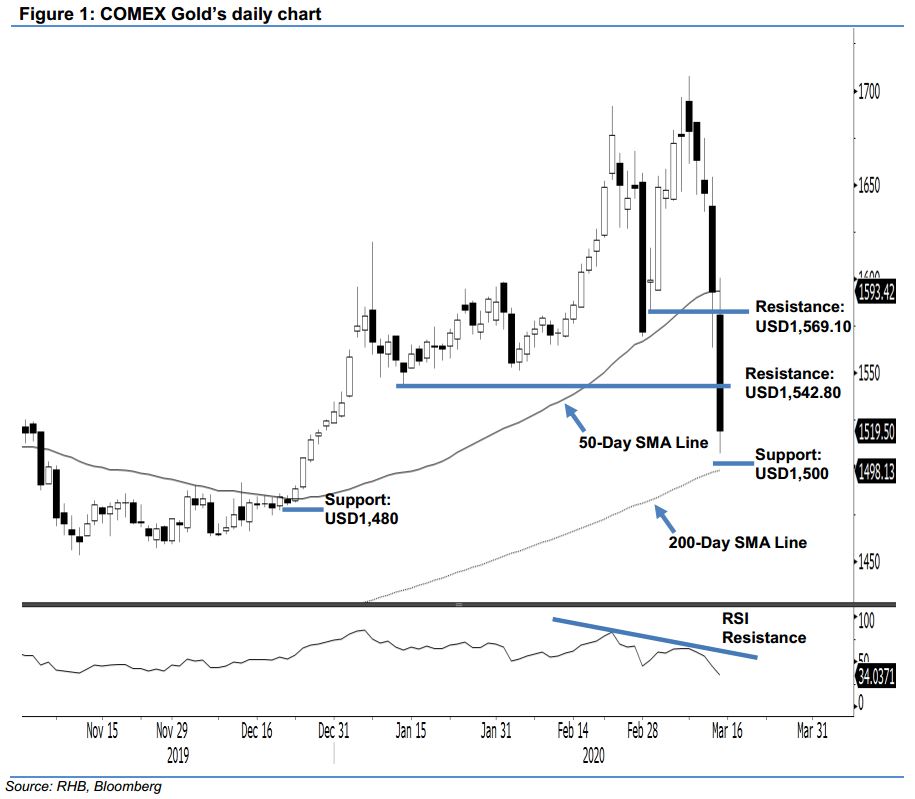

Maintain short positions as washout is extending. The COMEX Gold continued to experience a washout in the latest session. Trading range was wide at between USD1,507.00 and USD1,600.40, before closing USD73.70 lower at USD1,519.50. The negative session also saw the previous support levels of USD1,563.40 and USD1,542.80 as well as the 50-day SMA line breached – further supporting our downside bias.

Until there are clear price signals to indicate an interim low, we are keeping our negative trading bias. As the bears are having a clear control over the retracement, we maintain our recommendation for traders to stay in short positions. We initiated these at USD1,593.20, the closing level of 12 Mar. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

We revised the immediate support to the USD1,500 round figure. This is followed by USD1,480. Towards the upside, the immediate resistance is revised to USD1,542.80, the low of 14 Jan. This is followed by USD1,569.10 – the low of 2 Mar.

Source: RHB Securities Research - 16 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024