WTI Crude Futures - Minor Bounce

rhboskres

Publish date: Mon, 16 Mar 2020, 10:57 AM

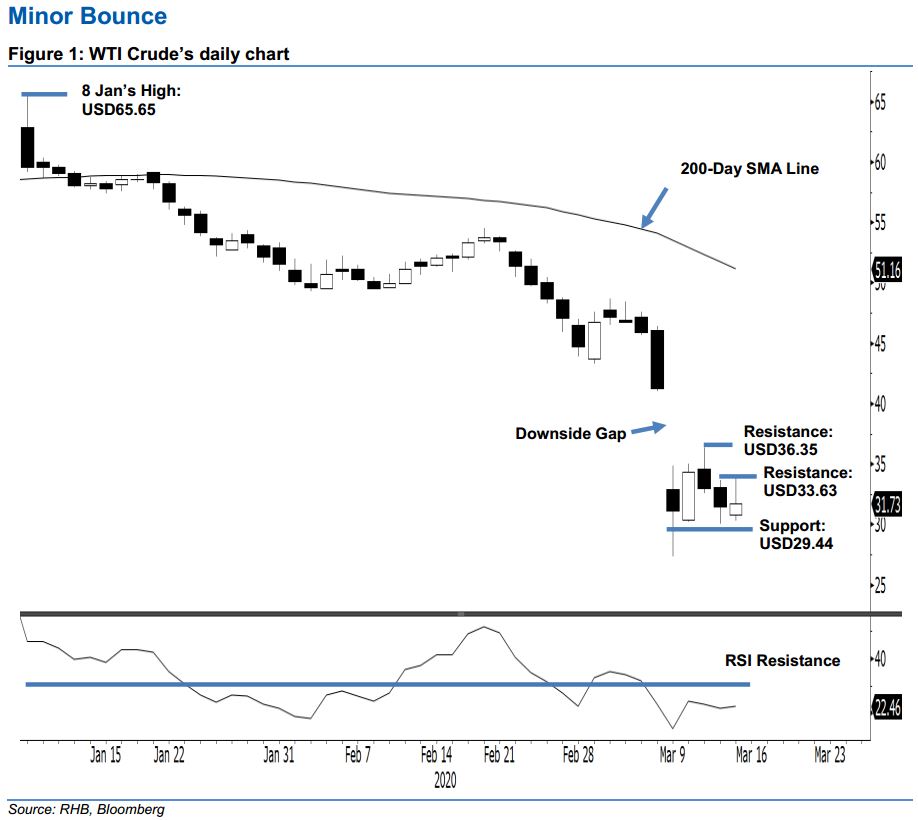

Maintain short positions as the downside risk is still high. The WTI Crude ended the latest session USD0.23 higher at USD31.73. This was after it hit a low and high of USD30.33 and USD33.87. The positive session can be seen as a sign that the bears are taking a pause. The overall trend, based on the daily chart, is still firmly negative. This is further supported by the 200-day SMA line which continues to trend downward. Premised on this, we are keeping our negative trading bias.

In the absence of a price signal to indicate the negative bias has reached an end, we are keeping our recommendation for traders to stay in short positions. We initiated these at USD31.50, the closing level of 12 Mar. To manage the risk, a stop-loss can be placed above the USD36.35 threshold.

The immediate support is now expected at USD30.33, the latest low. This is followed by USD29.44, derived from 9 Mar’s candle. Moving up, the immediate resistance is set at USD33.63, or the latest high. This is followed by USD36.35, which was the high of 11 Mar.

Source: RHB Securities Research - 16 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024