COMEX Gold - Another Steep Decline

rhboskres

Publish date: Tue, 17 Mar 2020, 10:59 AM

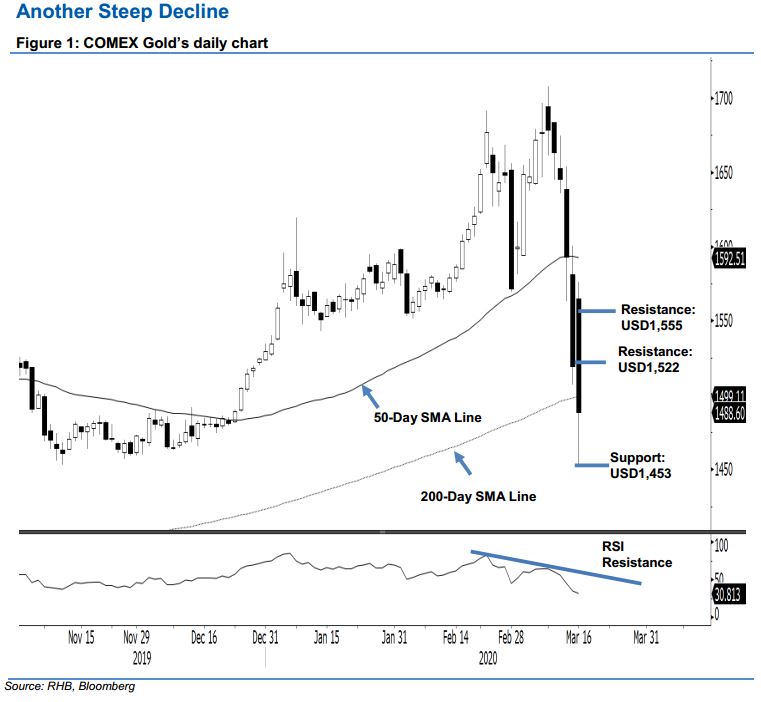

Maintain short positions as the 200-day SMA line gives way. The COMEX Gold continued to extend its steep decline for the third consecutive session. At the closing, the commodity fell USD30.90 to close at USD1,488.60 – after it reached a low and high of USD1,453 and USD1,576. The weak closing also now places the precious metal below both the USD1,500 level and the 200-day SMA line, with its RSI reading nearing the oversold threshold. As the correction phase is showing strong signs of extending, we stay with our negative trading bias.

Without a price signal to indicate a low has been reached, we maintain our recommendation for traders to stay in short positions. We initiated these at USD1,593.20, the closing level of 12 Mar. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

We revised the immediate support to USD1,453, the latest low, – this is followed by USD1,410. Moving up, the immediate resistance is now pegged at USD1,522, followed by USD1,555 – both are derived from the latest candle.

Source: RHB Securities Research - 17 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024