WTI Crude Futures - Trend Firmly Negative

rhboskres

Publish date: Tue, 17 Mar 2020, 11:01 AM

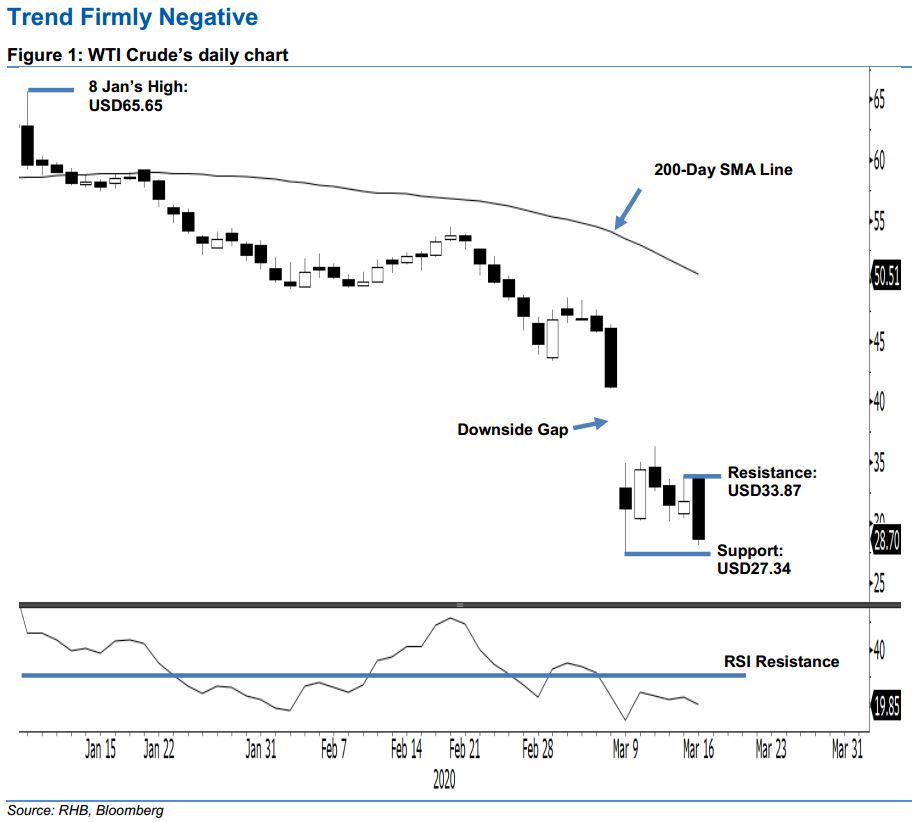

Maintain short positions as the bearish trend is extending. The WTI Crude formed a black candle to settle USD3.03 lower at USD28.70 – crossing below the previous immediate support of USD29.44. The low and high were recorded at USD28.10 and USD33.75. Despite the RSI reading flashing out an oversold reading, after the recent sharp decline, price actions continue to point towards a bearish trend extension. Premised on this, we are keeping our negative trading bias.

With the bears having a strong control over the price trend, we are keeping our recommendation for traders to stay in short positions. We initiated these at USD31.50, the closing level of 12 Mar. To manage the risk, a stoploss can be placed above the USD33.70 level.

The immediate support is revised to USD27.34, the low of 9 Mar. This is followed by USD26.05, the low of 11 Feb 2016. Towards the upside, the immediate resistance is set at USD31.60 – derived from the latest candle. This is followed by USD33.87, the high of 13 Mar.

Source: RHB Securities Research - 17 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024