Hang Seng Index Futures - Snaps 4-Day Losing Streak

rhboskres

Publish date: Wed, 18 Mar 2020, 05:09 PM

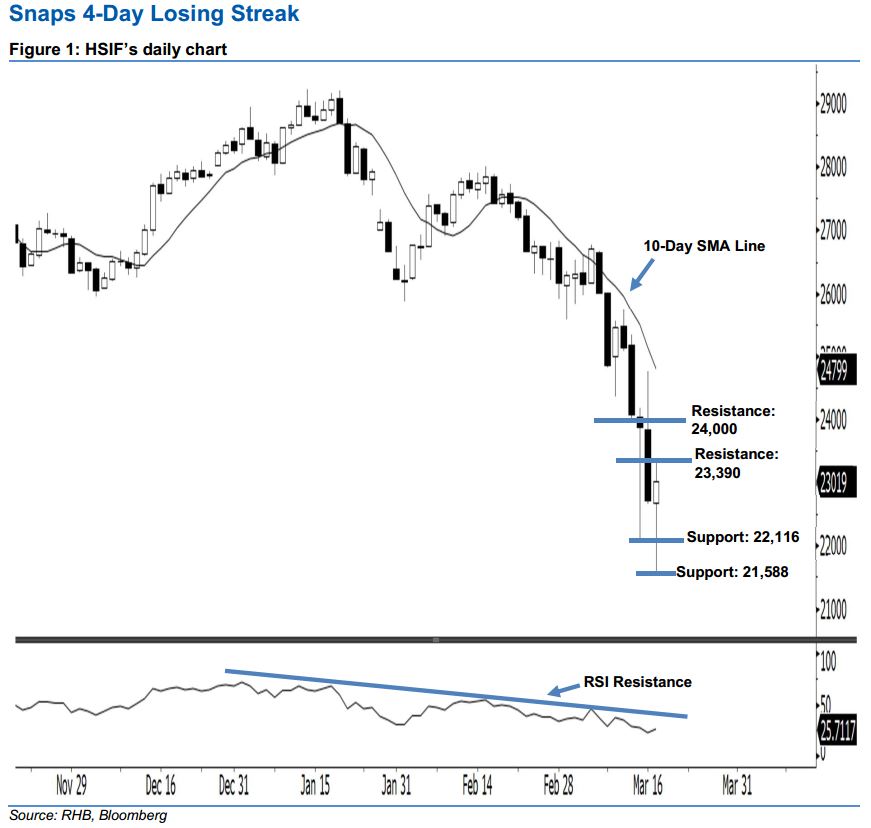

Stay short, with a trailing-stop set above the 23,390-pt level. Following the black candles that were formed on 11-16 Mar, the HSIF ended higher to form a white candle yesterday. It rose to a high of 23,390 pts during the intraday session before ending at 23,019 pts for the day. Unsurprisingly, yesterday’s white candle should merely be viewed as a result of a technical rebound following the recent losses. Technically, we think the bears may continue to control the market as long as the HSIF does not recoup more than 50% of the losses from 16 Mar’s long black candle. Overall, we keep our bearish view on the index’s outlook.

Based on the daily chart, the immediate resistance level is seen at 23,390 pts, ie the high of 17 Mar. The next resistance is anticipated at the 24,000-pt psychological mark. On the other hand, we are eyeing the near-term support levels at 22,116 pts and 21,588 pts, ie the lows of 13 Mar and 17 Mar.

To recap, we initially recommended traders to initiate short positions below the 25,000-pt level on 10 Mar. We continue to advise them to stay short for now, while setting a new trailing-stop above the 23,390-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 18 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024