COMEX Gold - Back Above the 200-Day SMA

rhboskres

Publish date: Wed, 18 Mar 2020, 05:10 PM

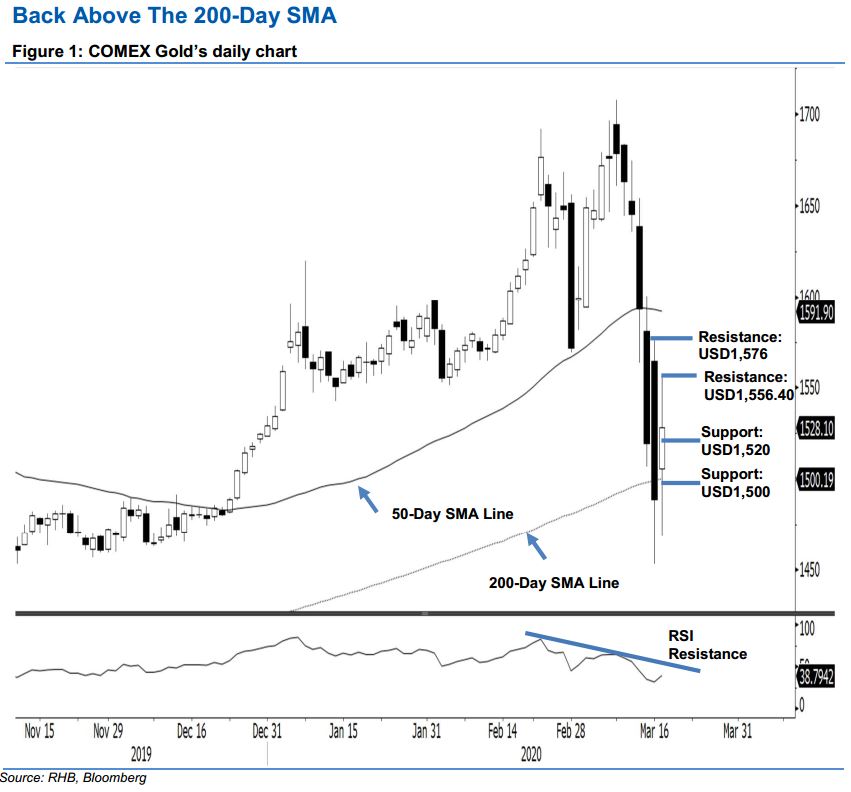

Maintain short positions while tightening up trailing-stops. The COMEX Gold halted its prior sharp declines of the last three sessions to recoup the 200-day SMA line during its latest session. The trading range was wide – between USD1,468.60 and USD1,556.40 – before closing USD39.50 stronger at USD1,528.10. The sharp rebound, coupled with the recapturing of the aforementioned SMA line, suggests the bulls are trying to reverse the commodity’s recent retracement phase. However, to confirm this, the COMEX Gold has to cross above the said latest high of USD1,566.40. Until this happens, we are keeping to our negative trading bias.

Pending further positive price signals in the coming sessions, we maintain our recommendation that traders stay in short positions. We initiated these at USD1,593.20, or the closing level of 12 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,556.40 mark.

We revised the immediate support to USD1,520, followed by USD1,500 – both were derived from the latest candle. Moving up, the immediate resistance is pegged at USD1,556.40, ie the latest high. This is followed by USD1,576, which was the price point of 16 Mar.

Source: RHB Securities Research - 18 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024