FKLI - a Sharp Intraday Reversal

rhboskres

Publish date: Wed, 18 Mar 2020, 05:23 PM

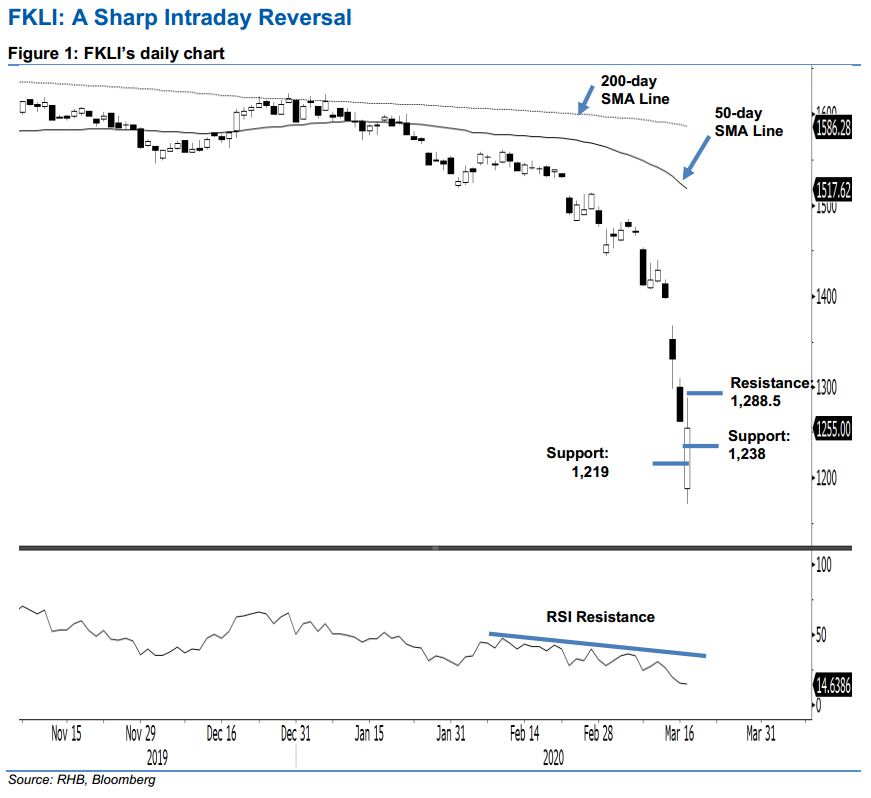

Initial signs of bulls attempting to stage a rebound; maintain short positions. The FKLI staged a sharp intraday price reversal in the latest session to close 6.5 pts lower at 1,255 pts. This was after it hit a low of 1,171 pts. The sharp intraday price rebound came on the back of recent sharp declines, which sent the RSI reading into an extremely oversold condition. Early price signals indicate that the downward move may be exhausted and a counter-trend rebound could be taking place. To confirm this, further price actions need to take place in the coming sessions. Hence, we keep to our negative trading bias.

Pending further positive price actions, traders should remain in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can now be placed above the 1,288.5-pt level.

The immediate support is revised to 1,238 pts, followed by 1,219 pts, both derived from the latest candle. Moving up, the immediate resistance is expected at 1,270 pts, followed by 1,288.5 pts – price points of the latest session.

Source: RHB Securities Research - 18 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024