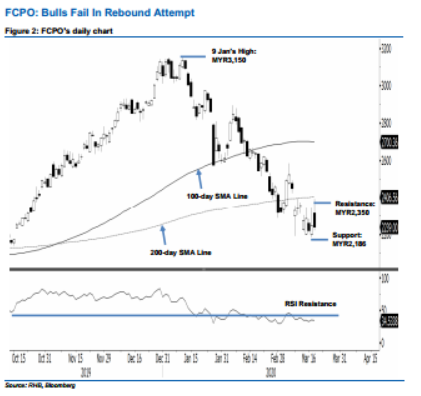

FCPO - Bulls Fail In Rebound Attempt

rhboskres

Publish date: Thu, 19 Mar 2020, 05:22 PM

Maintain short positions as the commodity failed to signal a reversal. The FCPO failed to hold on to its earlier session’s positive tone, which at one point saw it come in near to test the 200-day SMA line with a high of MYR2,393, before closing MYR1 lower at MYR2,220. The weak performance means the commodity is still unable to signal an end to its multi-month retracement. Premised on this, we are keeping our negative trading bias.

As there is no positive follow up by the bulls to suggest a possible trend reversal, traders are advised to remain in short positions. These were initiated at MYR2,332, the close of 9 Mar. To manage risks, a stop-loss can be placed above the MYR2,350 threshold.

The immediate support is maintained at MYR2,186, the low of 17 Mar, this is followed by MYR2,150. Towards the upside, the immediate resistance is now set at MYR2,300, followed by MYR2,3560, both are derived from the latest candle.

Source: RHB Securities Research - 19 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024