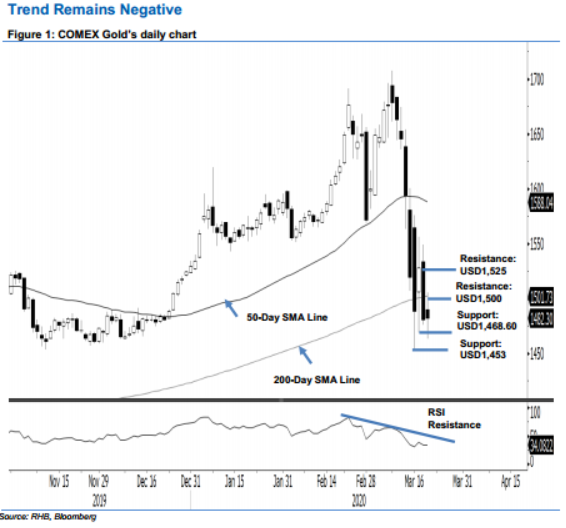

COMEX Gold - Trend Remains Negative

rhboskres

Publish date: Fri, 20 Mar 2020, 04:51 PM

No sign for fortunes to turn; maintain short positions. The COMEX Gold ended the latest session marginally better by USD1.70 at USD1,482.30. Trading took place in the range of USD1,462.80 and USD1,505.20. The session can be seen as an indication that the bulls are attempting to recoup both the USD1,500 round figure and the 200-day SMA line – but failed. On these bearish observations, we are keeping our negative trading bias.

As the bulls are still capped by the crucial 200-day SMA line, we maintain our recommendation that traders stay in short positions. We initiated these at USD1,593.20, or the closing level of 12 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,556.40 mark.

Immediate support is pegged at USD1,468.60, the low of 18 Mar. This is followed by USD1,453.00, the low of 16 Mar. Conversely, the immediate resistance is expected at the USD1,500 round figure, followed by USD1,525 – derived from 18 Mar’s candle.

Source: RHB Securities Research - 20 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024