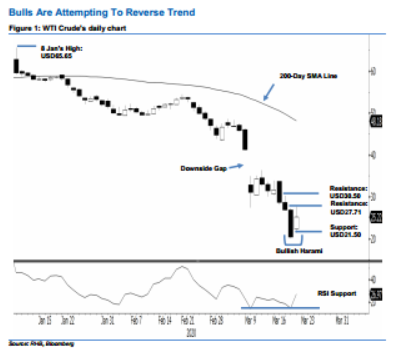

WTI Crude Futures - Bulls Are Attempting to Reverse Trend

rhboskres

Publish date: Fri, 20 Mar 2020, 04:53 PM

Maintain short positions, until reversal signal is confirmed. The WTI Crude staged an encouraging comeback after the prior session’s steep decline, adding USD4.85 to close at USD25.22. Trading remains volatile, with the low and high recorded at USD21.36 and USD27.71. Consequently, a “Bullish Harami” formation appeared – an early sign that the retracement leg may have reached an interim low. However, to confirm this, further positive price actions are required in the coming sessions. Pending this, we are keeping our negative trading bias.

Until a rebound signal is confirmed, we are keeping with our recommendation for traders to stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed at above the USD27.71 level.

The immediate support is revised to USD23.50, followed by USD21.50 – both are derived from the latest candle. Towards the upside, the immediate resistance is set at USD27.71, the latest high, followed by USD30.50.

Source: RHB Securities Research - 20 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024