Hang Seng Index Futures - Sentiment Remains Bearish

rhboskres

Publish date: Fri, 20 Mar 2020, 04:54 PM

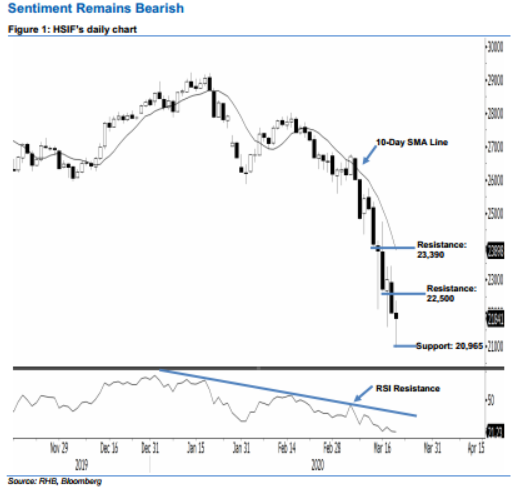

Stay short, with a trailing-stop set above the 22,500-pt level. The downside move in the HSIF has continued as expected, as a black candle was formed yesterday. It dropped to a low of 20,965 pts during the intraday session, before ending at 21,841 pts for the day. Technically, investor sentiment remains in bearish mode. This is as the HSIF marked a lower close below the declining 10-day SMA line and posted a second consecutive black candle. Overall, we maintain a negative view on the index’s outlook.

Based on the daily chart, we now anticipate the immediate resistance level at 22,500 pts, which is situated near the midpoint of 18 Mar’s black candle. If a breakout arises, look to 23,390 pts – ie the high of 17 Mar – as the next resistance. On the other hand, we are eyeing the near-term support level at the 21,000-pt psychological mark. This is followed by 20,965 pts, or the previous low of 19 Mar.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 25,000-pt level on 10 Mar. For now, a trailing-stop set above the 22,500-pt threshold is advisable to lock in a larger part of the profits.

Source: RHB Securities Research - 20 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024