E-mini Dow Futures - Downtrend Stays Intact

rhboskres

Publish date: Fri, 20 Mar 2020, 05:05 PM

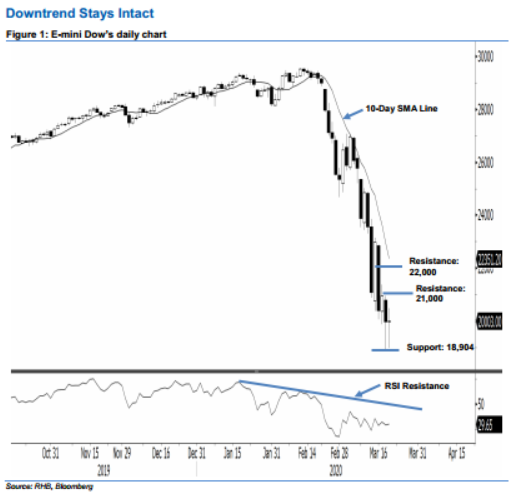

Maintain short positions. The E-mini Dow formed a “Doji” candle last night, settling at 20,003 pts after hovering between a high of 20,497 pts and low of 18,993 pts. Still, the bearish sentiment stays unchanged, as this candle can only be viewed as sellers probably taking a pause after the recent selldown. Since the index is still holding below the falling 10-day SMA line, this indicates that the downside move is not over yet. Overall, we believe the market correction that started in late February should likely persist in the coming sessions.

As seen in the chart, the immediate resistance level is now seen at 21,000 pts, set near the high of 18 Mar. The next resistance will likely be at the 22,000-pt psychological spot. To the downside, we maintain the near-term support level at 18,904 pts, ie the previous low of 18 Mar. This is followed by the 18,000-pt round figure.

Hence, we advise traders to maintain short positions, following our recommendation of initiating short below the 24,675-pt level on 10 Mar. For now, a trailing-stop can be set above the 21,000-pt threshold to secure a larger part of the gains.

Source: RHB Securities Research - 20 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024