FKLI - Curving Down Again

rhboskres

Publish date: Fri, 20 Mar 2020, 05:08 PM

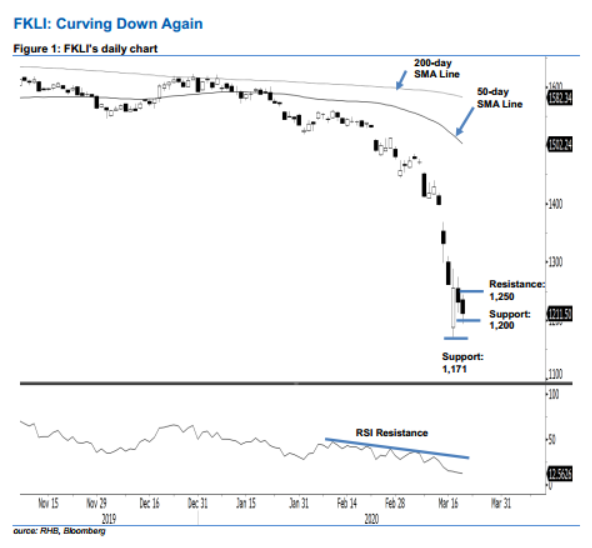

Bulls still on soft footing; maintain short positions. The FKLI closed 19.5 pts lower yesterday, at 1,211.5 pts. The intraday trend was also weak, as it generally moved lower for most of the session. Despite a sharp intraday rebound on 17 Mar, the latest two sessions’ weak performance does not mean that the index is ready to stage a counter-trend rebound yet – even though the RSI reading of 11 points to an oversold situation. Premised on this, we are keeping our negative trading bias.

As such, traders are advised to remain in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can now be placed above the 1,250-pt level.

The immediate support is revised to the 1,200-pt round figure, followed by 1,171 pts, the low of 17 Mar. Moving up, the immediate resistance is now pegged at 1,235 pts – derived from the latest price range. This is followed by 1,250 pts.

Source: RHB Securities Research - 20 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024