Hang Seng Index Futures - Long Positions Activated

rhboskres

Publish date: Mon, 23 Mar 2020, 10:06 AM

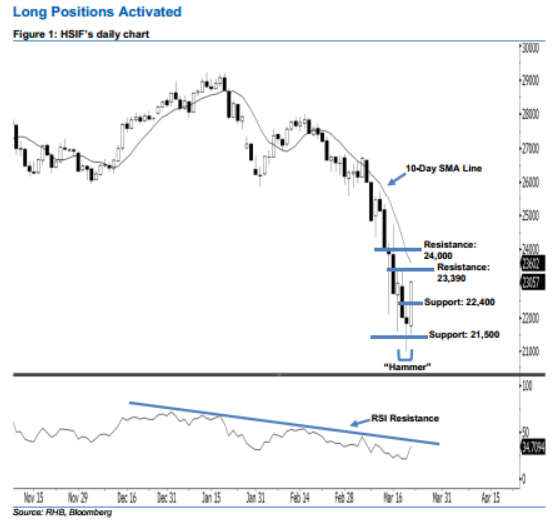

Initiate long positions above the 22,400-pt level. The HSIF formed a long white candle last Friday. It gained 1,216 pts to close at 23,057 pts. Technically, the index has recouped most of the previous two sessions’ losses and breached above the 22,500-pt resistance mentioned previously, implying that sentiment has turned positive. This can be viewed as a continuation of the buyers extending the rebound from 19 Mar’s “Hammer” pattern. Last Friday’s closing also triggered our previous trailing-stop recommendation at the 22,500-pt threshold – which has locked in part of the profit. Note we initially advised traders to initiate short below the 25,000-pt level on 10 Mar.

Currently, the immediate support level is seen at 22,400 pts, ie near the high of 19 Mar. The next support would likely be at the 21,500-pt round figure. Towards the upside, the immediate resistance level is seen at 23,390 pts, determined from the high of 17 Mar. If a decisive breakout arises, the next resistance is anticipated at the 24,000- pt psychological mark.

Thus, we advise traders to initiate fresh long positions above the 22,400-pt level. A stop-loss can be set below the 21,500-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 23 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024