E-mini Dow Futures - Still Bearish

rhboskres

Publish date: Mon, 23 Mar 2020, 10:06 AM

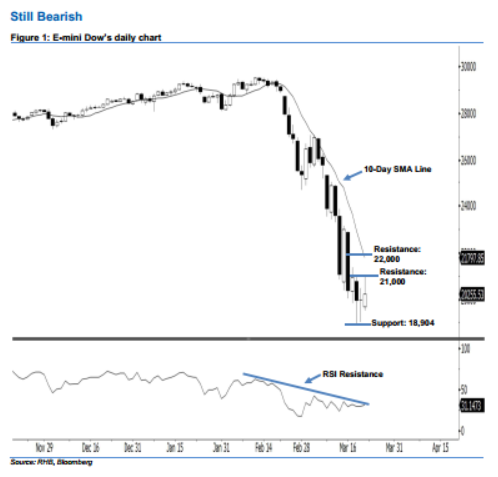

Stay short while setting a trailing-stop above the 21,000-pt resistance. The E-mini Dow formed a positive candle with a long upper shadow last Friday. It settled at 20,255.53 pts, off the session’s high of 20,999 pts. From a technical perspective, investor sentiment remains bearish. This is as the E-mini Dow has remained below the declining 10-day SMA line for more than a month. Meanwhile, last Friday’s long upper shadow shows that there was buying momentum during the day before the market pushed it down by the end of the trading session. This suggests that the sellers still have control over the market.

Presently, we maintain the immediate resistance level at 21,000-pt, determined near the high of 18 Mar. If a decisive breakout arises, the next resistance is seen at the 22,000-pt psychological mark. On the other hand, we anticipate the immediate support level at 18,904 pts, which was the low of 18 Mar. Meanwhile, the next support would likely be at the 18,000-pt round figure.

Therefore, we advise traders to stay short, given that we initially recommended initiating short below the 24,675-pt level on 10 Mar. A trailing-stop set above the 21,000-pt threshold is preferable in order to lock in part of the profits.

Source: RHB Securities Research - 23 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024