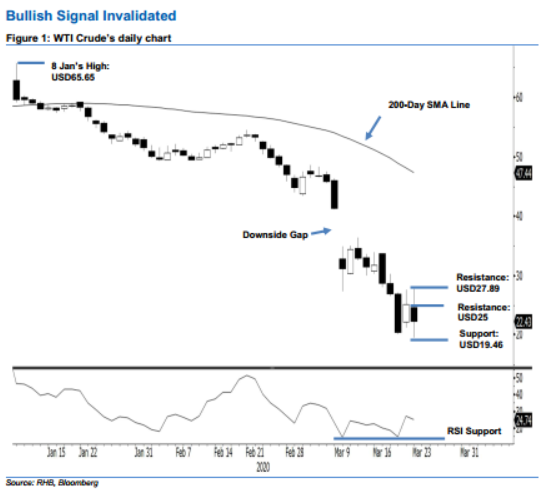

WTI Crude Futures - Bullish Signal Invalidated

rhboskres

Publish date: Mon, 23 Mar 2020, 10:07 AM

Bears are still in firm control; maintain short positions. The WTI Crude gave up USD2.79 to settle at USD22.43 in the latest session. This was after it ranged between a low and high of USD19.46 and USD27.89. The negative session has also nullified 19 Mar’s “Bullish Harami” formation. This suggests the commodity’s retracement phase, which started from the high of USD65.65 on 8 Jan, is still not showing signs of reaching its low, despite the RSI still flashing out an oversold reading. Premised on this, we are keeping our negative trading bias.

In the absence of a price reversal signal, we are keeping with our recommendation for traders to stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed at above the USD27.89 level.

The immediate support is revised to the USD20 round figure, followed by USD19.46, the latest low. Moving up, the immediate resistance is now pegged at USD25.00, followed by USD27.89, the latest high.

Source: RHB Securities Research - 23 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024