FCPO - Rebound Needs Further Confirmati

rhboskres

Publish date: Tue, 07 Apr 2020, 06:13 PM

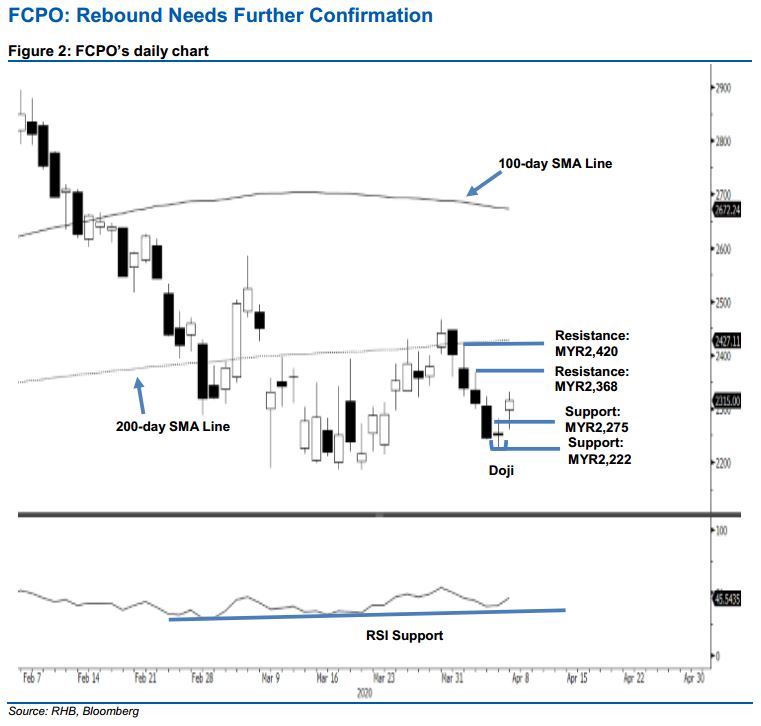

Pending rebound confirmation; maintain short positions. The FCPO ended the latest session strong, adding MYR65 to close at MYR2,315. The low and high were posted at MYR2,261 and MYR2,332. The encouraging session can be seen as a positive follow-up from the prior session’s “Doji” formation – this suggests a possibility that the retracement subsequent from the recent price rejection from the 200-day SMA line is entering a minor consolidation phase. However, to confirm that a deeper rebound is developing, further positive price actions in the coming sessions are required. Premised on this, we are keeping our negative trading bias.

As we have yet to see signs of a stronger rebound taking place, we keep to our recommendation for traders to stay in short positions. We initiated these at MYR2,339, the closing level of 1 Apr. To manage risks, a stop-loss can be placed at the breakeven level.

We revised the immediate support to MYR2,275, derived from the latest candle, followed by MYR2,222, the low of 6 Mar. Moving up, the immediate resistance is now eyed at MYR2,368, the high of 2 Apr. This is followed by MYR2,420, the high of 1 Apr, also near the 200-day SMA line.

Source: RHB Securities Research - 7 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024