COMEX Gold - Negative Intraday Reversal

rhboskres

Publish date: Wed, 08 Apr 2020, 06:09 PM

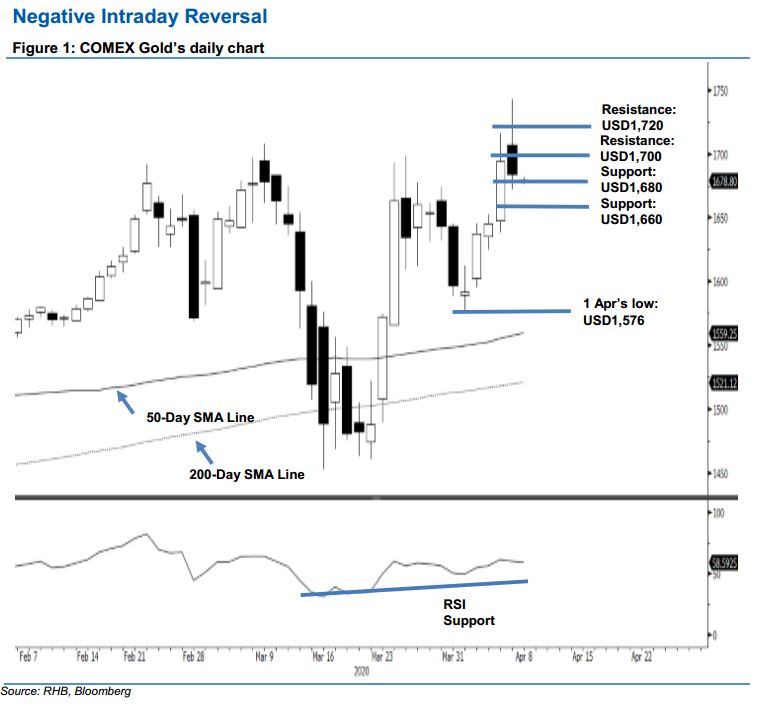

Maintain long positions while moving up the stop-loss. The COMEX Gold experienced a sharp negative intraday price reversal in the latest session. After opening with a strong tone with a high of USD1,742.60, the precious metal generally trended lower for the entire session – at the closing, it settled USD10.20 lower at USD1,683.70. For now, we view the weak session as an indication of profit-taking activity, after the commodity experienced a relatively sharp run over the past week. This was after it completed its correction phase which reached a low of USD1,576. We believe the trading bias stays positive for now, as prices are holding above both the 50-day and 200-day SMA lines which are still trending upward. Meanwhile, the RSI reading has yet to show overbought conditions.

Until signs for a deeper correction emerge, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,640 level.

Immediate support is maintained at USD1,680, derived from 6 Apr’s candle. This is followed by USD1,660. Moving up, the immediate resistance is expected at the USD1,700 round figure, followed by USD1,720.

Source: RHB Securities Research - 8 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024