WTI Crude Futures - Stop Loss Triggered

rhboskres

Publish date: Wed, 08 Apr 2020, 06:10 PM

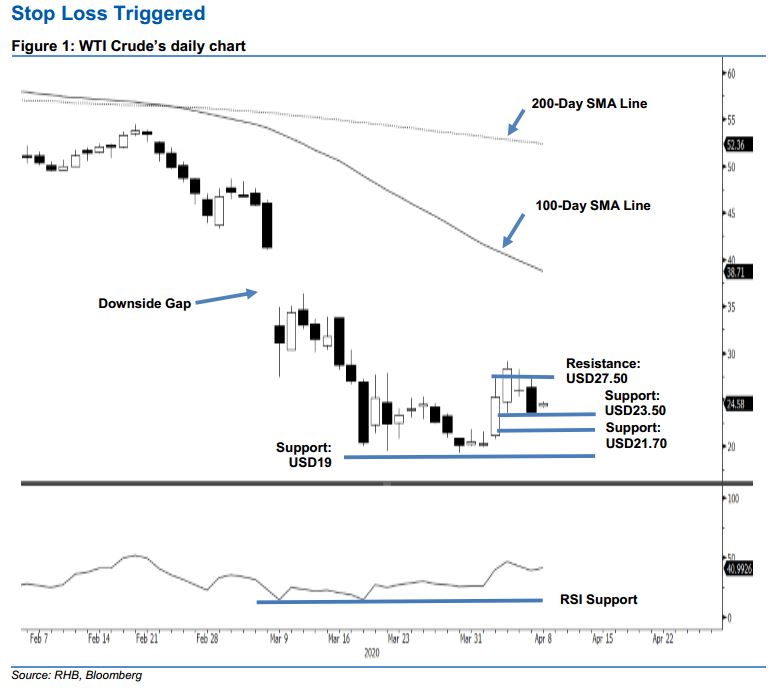

Initiate short positions as the rebound hit a wall. The WTI Crude marked a second consecutive session of weak settlement. At the closing, it fell USD2.45 to end at USD23.63. The weak session also placed the commodity below the previous immediate support of USD25.00. This could mean the one-week counter-trend rebound that set in on the back of an oversold RSI reading after a multi-week retracement has probably reached its interim top at USD29.13 recently. Based on this, chances are high that the commodity could be at risk of resuming its downtrend. Hence, we switch our trading bias to negative.

Our previous long positions were initiated at USD25.32, while the closing level of 2 Apr was closed out at the breakeven point in the latest session. As the risk for the retracement to resume is high, we initiate short positions at the latest close. To manage the risk, a stop-loss can be placed at the USD27.50 mark.

The immediate support is revised to USD23.50, followed by USD21.70. Towards the upside, the immediate resistance is eyed at USD25.00, followed by USD27.50.

Source: RHB Securities Research - 8 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024