FCPO - Signs For a Strong Rebound

rhboskres

Publish date: Thu, 09 Apr 2020, 08:54 PM

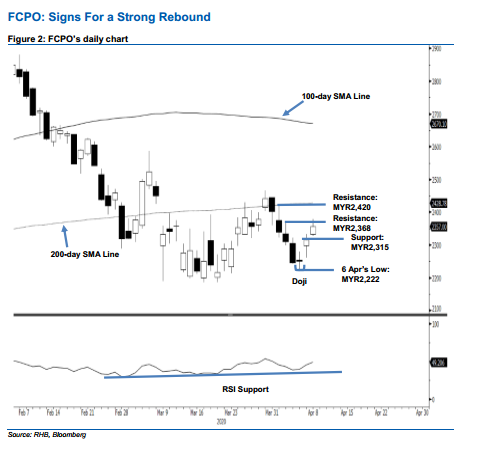

Initiate long positions as strong rebound may be taking place. The FCPO extended its positive closing for the third consecutive session, adding MYR42 to close at MYR2,357. It also briefly tested the immediate resistance of MYR2,368 with a high of MYR2,378. The encouraging session is a positive follow-up from the 6 Apr’s “Doji” formation and is indicating the commodity is likely to stage a stronger rebound phase. Looking at the bigger technical picture, this rebound leg can be seen as part of the commodity’s sideways trading pattern that has been in the development since early March. On this basis, we switch our trading bias to positive.

Our previous short positions initiated at MYR2,339, the closing level of 1 Apr, were closed out at the breakeven in the latest session. We also initiate long positions at the latest closing. To manage risks, a stop-loss can be placed at below MYR2,222.

We revised the immediate support MYR2,315, derived from 7 Apr’s candle. This is followed by MYR2,275. Meanwhile, the immediate resistance is set at MYR2,368, the high of 2 Apr. This is followed by MYR2,420, the high of 1 Apr, also near the 200-day SMA line.

Source: RHB Securities Research - 9 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024