WTI Crude Futures - No Reversal Signal Yet

rhboskres

Publish date: Thu, 09 Apr 2020, 09:01 PM

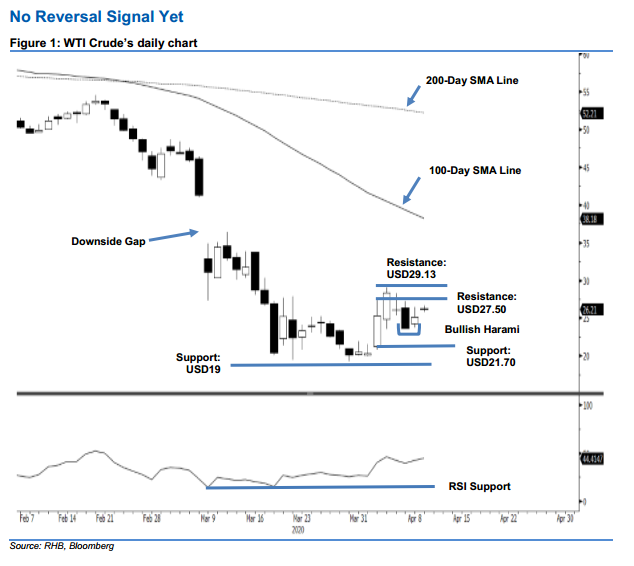

Maintain short positions as the retracement risk remains. The WTI Crude ended the latest session on a strong footing, adding USD1.46 to close at USD25.09. Consequently, a “Bullish Harami” formation appeared. The positive session came after the commodity experienced three consecutive sessions of weak closings. However, it was not sufficient to signal the end of the said recent retracement – as we believe further positive price actions are needed to confirm the said formation. All in, we believe the commodity’s counter-trend rebound that started from an area near USD19.00 has likely reached its top of USD29.13 on 3 Apr – implying the risk of downtrend resumption is high. Maintain negative trading bias.

Until a signal for a stronger rebound appears, we continue to suggest traders stay in short positions. These were initiated at USD23.63, the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at the USD27.50 mark.

We are keeping the immediate support at USD23.50, followed by USD21.70. Towards the upside, the immediate resistance is eyed at USD27.50. This is followed by USD29.13, the high of 3 Apr.

Source: RHB Securities Research - 9 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024