FCPO - Profit-Taking Kicks In

rhboskres

Publish date: Fri, 10 Apr 2020, 06:11 PM

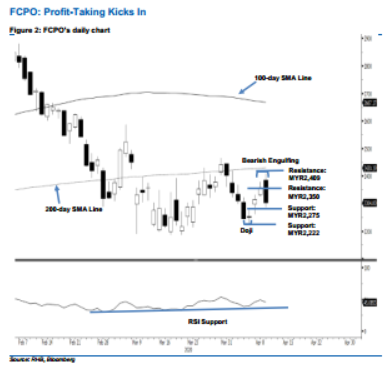

Maintain long positions, as the multi-week sideways trading pattern is still in place. The FCPO recorded a sharp negative intraday price reversal yesterday, closing MYR53 lower at MYR2,304 after hitting a high of MYR2,409. As a result, a “Bearish Engulfing” formation appeared. The weak performance can be seen as possible profit-taking activity, after the commodity had three sessions in which it marked positive closes. However, this has yet to invalidate the case for the commodity to extend its rebound. The rebound resumed after the FCPO reached a low of MYR2,222 on 6 Apr – which can be regarded as a part of the sideways trading pattern that has been in development since early March. We maintain our positive trading bias.

Traders should stay in long positions, which we initiated at MYR2,357, the closing level of 8 Apr. To manage risks, a stop-loss can be placed at below MYR2,222.

We revised the immediate support to MYR2,275. This is followed by MYR2,222, the low of 6 Apr. Towards the upside, the immediate resistance is eyed at MYR2,350, derived from the latest candle, followed by MYR2,409, the latest high.

Source: RHB Securities Research - 10 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024