COMEX Gold - Positive Trend Remains Firm

rhboskres

Publish date: Mon, 13 Apr 2020, 09:47 AM

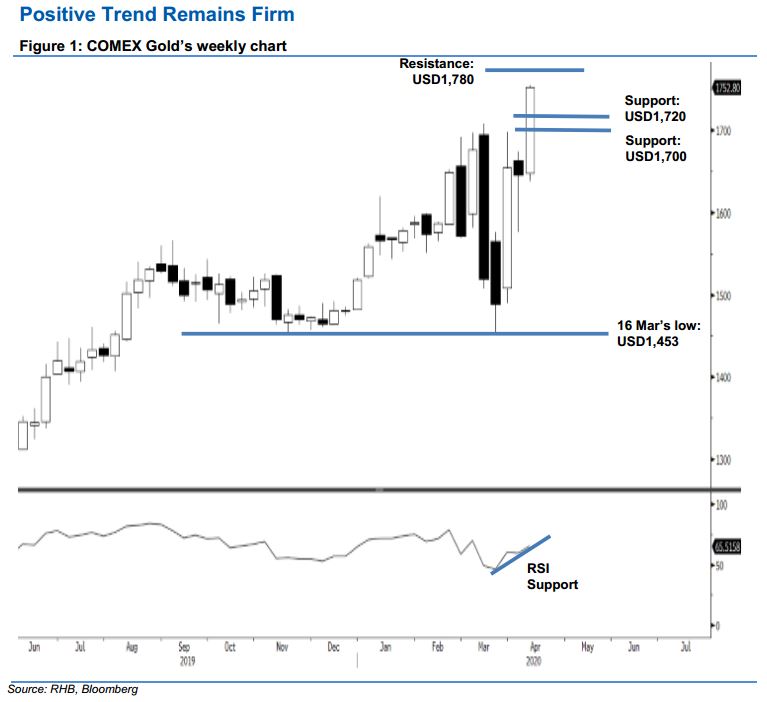

The multi-quarter uptrend is extending; maintain long positions. We are taking a look at COMEX Gold’s weekly chart in this note. The precious metal has been experiencing a multi-quarter uptrend. In the process, it also experienced correction phases of various magnitudes. The latest bigger magnitude correction phase was between 9-16 Mar – which saw the commodity reach a low of USD1,453 to retest November 2019’s low. Since then, the commodity has resumed its uptrend, and last week crossed above the USD1,700 resistance mark, after several attempts since the third week of February – a positive price signal indicating a trend extension. With the RSI reading still picking up without showing signs of overbuying, we are keeping our positive trading bias.

On the observation that the bulls are having a firm control over the trend, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,676.50 mark.

Support levels are pegged at USD1,720 and USD1,700 – both are derived from 9 Apr’s candle. Moving up, the immediate resistance is now pegged at USD1,780, followed by the USD1,800 round figure.

Source: RHB Securities Research - 13 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024