E-mini Dow Futures - Bearish Mode Intact

rhboskres

Publish date: Mon, 13 Apr 2020, 09:48 AM

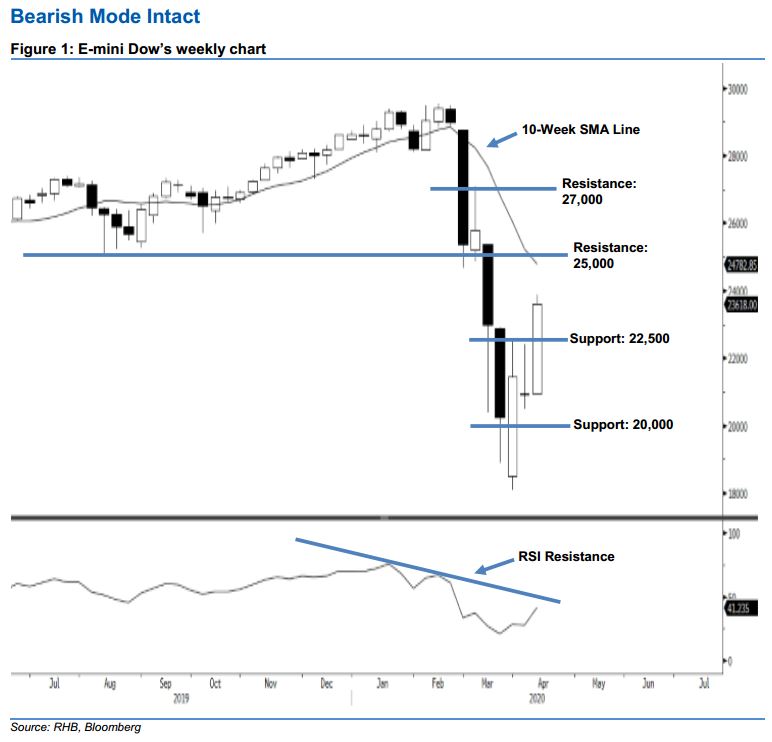

Bearish outlook stays intact. Today, we analyse the E-mini Dow’s trend based on its weekly chart. Judging from this chart, we do not anticipate the market trend to turn positive now. This is as the index has failed to break above the 25,000-pt threshold. Meanwhile, the E-mini Dow is still trading below the declining 10-week SMA line, suggesting that the bears could be extending the downward momentum in coming sessions. Overall, we view the recent buying momentum as a technical rebound. This was after the market correction that began in mid-February.

Based on the weekly chart, we anticipate the immediate resistance level at the 25,000-pt round figure, set near the 10-week SMA line as well. The next resistance is seen at 27,000 pts, near the high of 4 Mar. To the downside, the immediate support level is situated 22,500 pts, attached near the midpoint of last week’s long white candle. The next support would likely be at the 20,000-pt psychological spot.

However, based on our analysis of the daily chart, we advise traders to stay long. This is because the market is still trading above the 22,545-pt support mentioned in our 10 Apr daily report. Kindly refer to this report for further details.

Source: RHB Securities Research - 13 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024