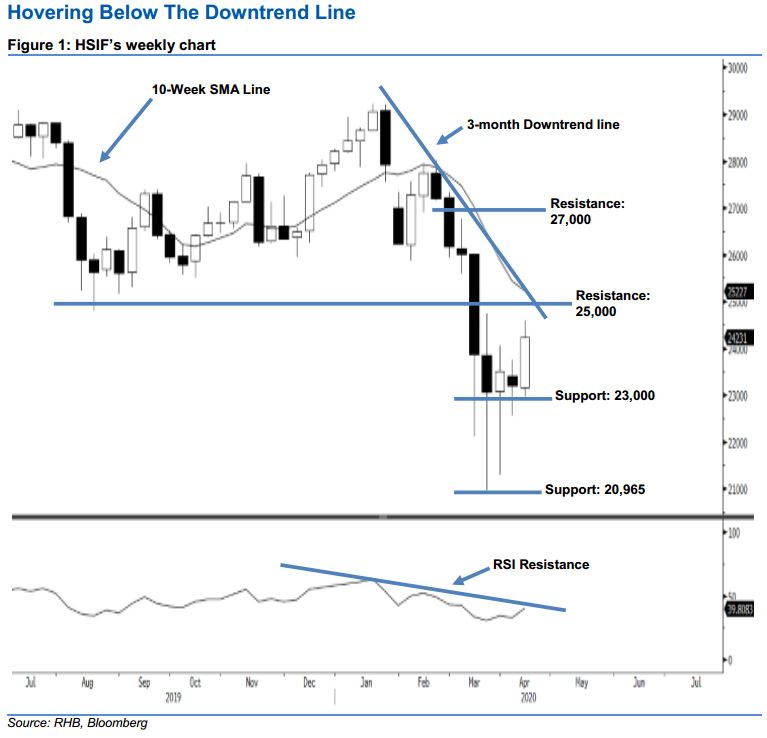

Hang Seng Index Futures - Hovering Below the Downtrend Line

rhboskres

Publish date: Mon, 13 Apr 2020, 09:49 AM

The market is holding below the 3-month downtrend line. Today, we analyse the HSIF’s longer-term trend. Based on the weekly chart, we believe the market trend is considered negative. This is because the index is still trading below the 3-month downtrend line drawn in the weekly chart. This line consists of the highest point of Jan, Feb, and Mar. We view last week’s white candle as a technical rebound only. That said, this negative sentiment is likely to remain unchanged, as long as the prices are trading below the aforementioned downtrend line.

As seen in the weekly chart, we are eyeing the immediate resistance level at the 25,000-pt round figure, also set near the downtrend line above. The next resistance would likely be at the 27,000-pt psychological mark. On the other hand, the immediate support level is seen at 23,000 pts, set near the low of last week’s white candle. The crucial support is anticipated at 20,965 pts, ie the previous low of 19 Mar.

However, based on our analysis of the daily chart, we advise traders to maintain long positions, given that the market is holding above the 23,500-pt support mentioned in our daily chart. Please refer to our 10 Apr report for more details.

Source: RHB Securities Research - 13 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024