WTI Crude Futures - Support Is Crushed

rhboskres

Publish date: Wed, 15 Apr 2020, 05:44 PM

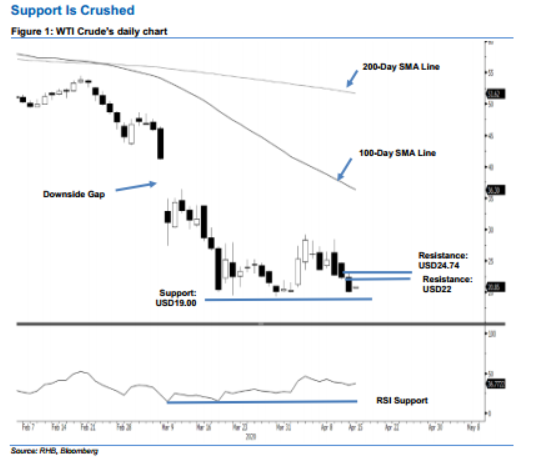

Maintain short positions as prospect for retracement to extend stays strong. The WTI Crude continued to signal a weak tone, ceding USD2.30 to close at USD20.11. The closing price placed the commodity below the previous immediate support of USD21.70. All in, the commodity is likely on the path of extending its multi-month sharp downward move – this was after it completed its counter-trend rebound on 3 Apr with a high of USD29.13. The RSI reading has yet to indicate an oversold situation, while both the 100-day and 200-day SMA lines are still curving downward. Maintain our negative trading bias.

As the downtrend is still showing signs of extending, we continue to suggest traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at above the USD24.74 mark.

We revised the immediate support level to USD19.00 mark, followed by USD18.00. Towards the upside, the immediate resistance is now set at USD22.00, derived from the latest candle. This is followed by USD24.74 – the high of 13 Apr.

Source: RHB Securities Research - 15 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024