COMEX Gold - Profit-Taking Near Immediate Resistance

rhboskres

Publish date: Wed, 15 Apr 2020, 05:47 PM

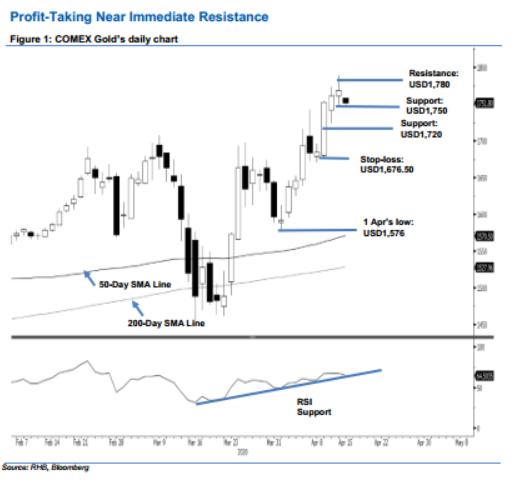

Maintain long positions as the positive trend is still firm. The COMEX Gold ended the latest session higher by USD7.50 at USD1,768.90. At one point, it tested the immediate resistance of USD1,780 with a high of USD1,788.80. The latest price action suggests there could be some minor profit-taking activity near the said immediate resistance, a normal development considering prices have come up quite substantially over the recent sessions. This means we have yet to see signs of the multi-month uptrend reaching its top – further supported by the RSI reading which is still below the overbought threshold. Maintain our positive trading bias.

As the trend is still firmly positive, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,676.50 mark.

The immediate support level is pegged at USD1,750 – derived from 13 Apr’s candle – followed by USD1,720. Meanwhile, the immediate resistance is expected to emerge at USD1,780, followed by the USD1,800 round figure.

Source: RHB Securities Research - 15 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024