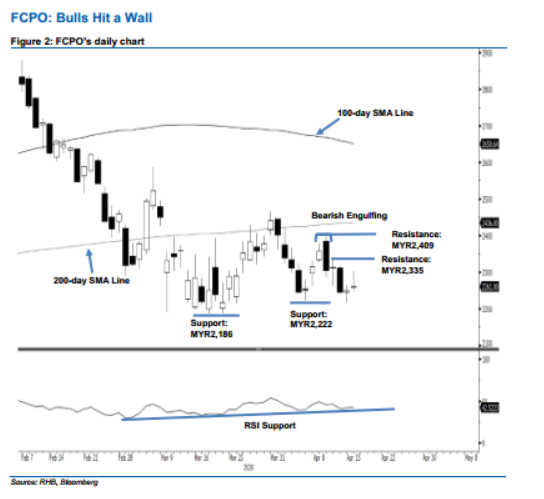

FCPO- Bulls Hit a Wall

rhboskres

Publish date: Thu, 16 Apr 2020, 04:34 PM

No clear reversal signal spotted; maintain short positions. The FCPO was not able to hold on to most of its intraday gains. At the closing, it rose MYR11 higher at MYR2,261 – the high was posted at MYR2,303. The inability to sustain most of its intraday gains suggests the commodity was still not able to flash out a price reversal signal. Recall that the latest retracement leg resumed after the emergence of the “Bearish Engulfing” formation on 9 Apr. This means the bias is still strong for it to test the MYR2,186 support mark, as part of the sideways trading pattern has been in development since early March. Hence, we are keeping our negative trading bias.

We recommend that traders stick to short positions, We initiated these at MYR2,246, the close of 13 Apr. For risk management purposes, a stop-loss can now be placed above MYR2,303.

We are keeping the immediate support at MYR2,222, the low of 6 Apr. This is followed by MYR2,186, the low of 17 Mar. Towards the upside, the immediate resistance is set at MYR2,335, the high of 10 Apr, followed by MYR2,409 – the price point of 9 Apr.

Source: RHB Securities Research - 16 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024