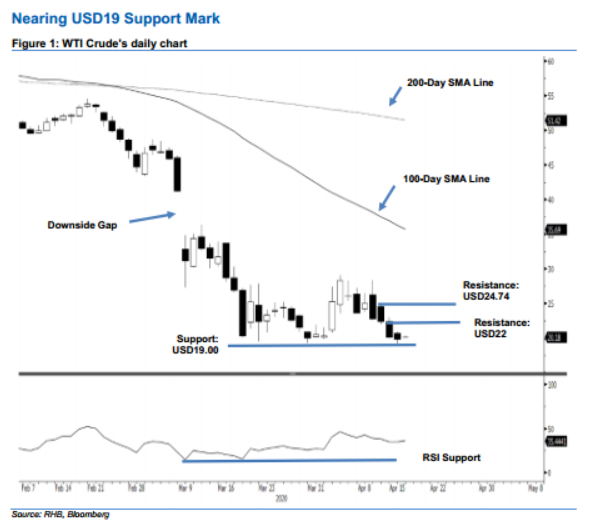

WTI Crude Futures - Nearing USD19 Support Mark

rhboskres

Publish date: Thu, 16 Apr 2020, 04:36 PM

Trend stays bearish; maintain short positions. The WTI Crude’s negative trend continued to extend in the latest session. At one point, it reached a low of USD19.20, ie near the support of USD19.00, before closing at USD19.87 – indicating a decline of USD0.24. This implies the commodity’s multi-month downtrend, which started from the high of USD65.65 in January, is not showing signs of hitting a low. The downtrend resumed after the commodity completed its 1-week counter-trend rebound on 3 Apr with a high of USD29.13. Until a price reversal signal appears, we are keeping our negative trading bias.

In the absence of a price signal to mark an end to the retracement phase, we continue to suggest traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at the breakeven mark.

Immediate support is set at USD19.00 mark, followed by USD18.00. Moving up, the immediate resistance is now set at USD22.00, derived from 14 Apr’s candle. This is followed by USD24.74 – the high of 13 Apr.

Source: RHB Securities Research - 16 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024