COMEX Gold - Immediate Support Breached

rhboskres

Publish date: Thu, 16 Apr 2020, 04:46 PM

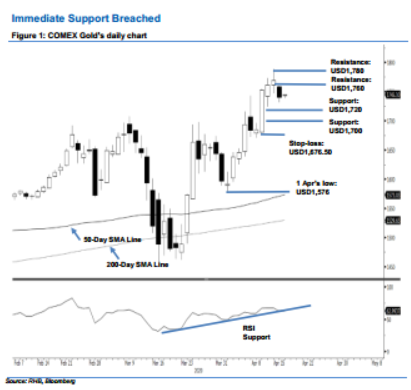

Profit taking is still relatively mild; maintain long positions. The COMEX Gold slid USD28.70 to settle at USD1,740.20 – breaching the previous immediate support of USD1,750. The negative session came after the commodity tested the USD1,780 resistance mark in the prior session. At this juncture, we are not seeing this as a possible uptrend price exhaustion signal. Instead, it can be seen as profit-taking activity, after the recent upward move. Additionally, the commodity is still trading relatively comfortably above the USD1,700 mark, a level that it recently crossed above, after multiple attempts since February. Premised on this, we are keeping our positive trading bias.

Until trend exhaustion signals emerge, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,676.50 mark.

The immediate support level is revised to USD1,720, followed by the USD1,700 round figure. Conversely, the immediate resistance is now expected at USD1,760, near the latest high, followed by USD1,780.

Source: RHB Securities Research - 16 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024