FKLI - Tightening Up Stop-Loss

rhboskres

Publish date: Mon, 20 Apr 2020, 02:20 PM

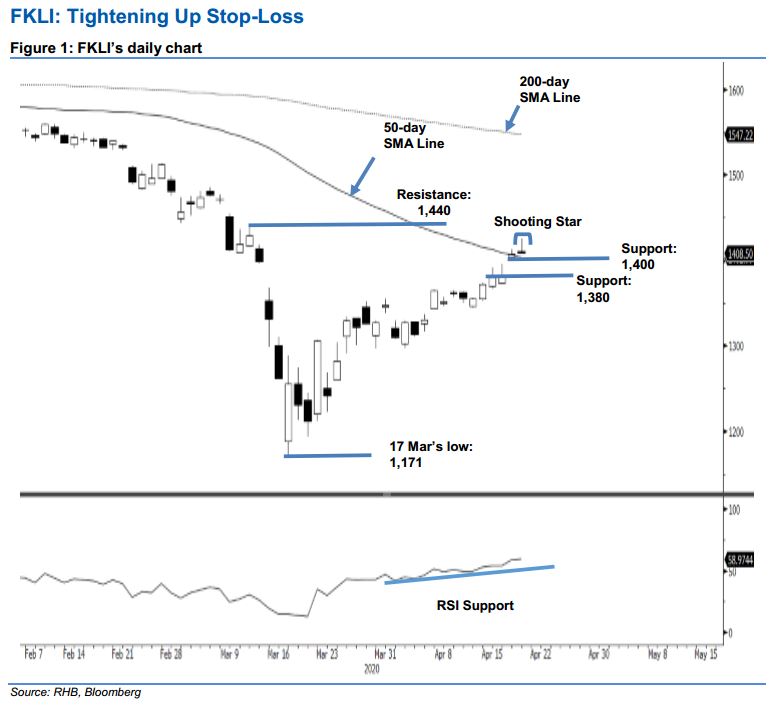

Price exhaustion signal pending confirmation; maintain long positions. The FKLI lost most of its intraday gains to close 1pt higher yesterday, at 1,408.5 pts. Earlier, it tested the immediate resistance of 1,415 pts with a high of 1,425.5 pts. Consequently, a bearish “Shooting Star” formation appeared – indicating a possible price exhaustion signal. However, as the index is still holding above the 50-day SMA line, further negative price actions are needed in the coming sessions to confirm that the counter-trend rebound has indeed reached its interim top. We are looking at the downside breach of 1,400-pt level for such a confirmation. We maintain our positive trading bias for now.

For now, traders should stay in long positions. We initiated these at 1,330.5 pts, the closing level of 6 Apr. To manage risks, a stop-loss can be placed below the 1,400-pt level

The immediate support is revised to 1,400 pts, followed by 1,380 – the price point of 17 Apr. Moving up, the immediate resistance is at 1,415 pts – a level slightly above the 50-day SMA line, followed by 1,440 pts – the high of 11 Mar.

Source: RHB Securities Research - 20 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024