WTI Crude Futures - a Historic Washout

rhboskres

Publish date: Tue, 21 Apr 2020, 02:00 PM

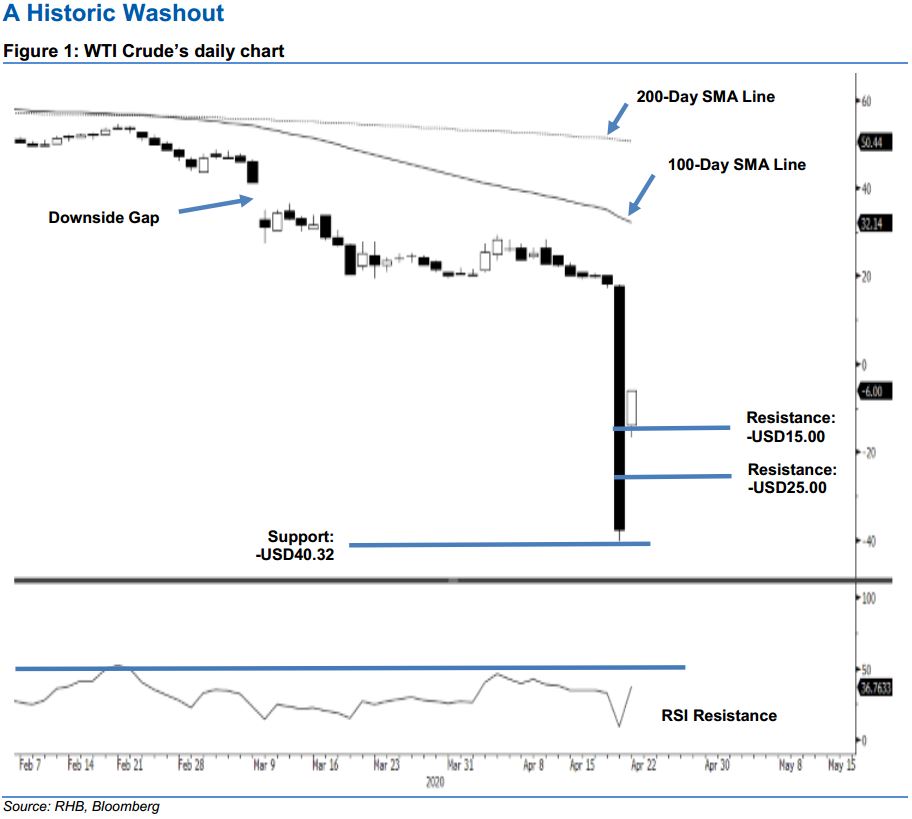

An unexpected washout session; maintain short positions. The WTI Crude ended the latest session in historic fashion, settling at -USD37.63 – a whopping USD19.36 decline. The negative session continued to indicate the commodity’s multi-month weak trend, which started in early January and is still not showing any signs of abating. The negative trend is also supported by both the 100-day and 200-day SMA lines, which are trending downwards. While the RSI is flashing out an oversold reading, in the absence of a price-reversal signal, we are keeping our negative trading bias.

As the trend is still firmly negative, we continue to suggest that traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at the breakeven mark.

The immediate support is revised to -USD40.32, which was the latest low. This is followed by the -USD45.00 level. Moving up, the resistance points are pegged at -USD25.00 and -USD15.00 – both are derived from the latest candle.

Source: RHB Securities Research - 21 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024