COMEX Gold - Back to Above USD

rhboskres

Publish date: Tue, 21 Apr 2020, 02:07 PM

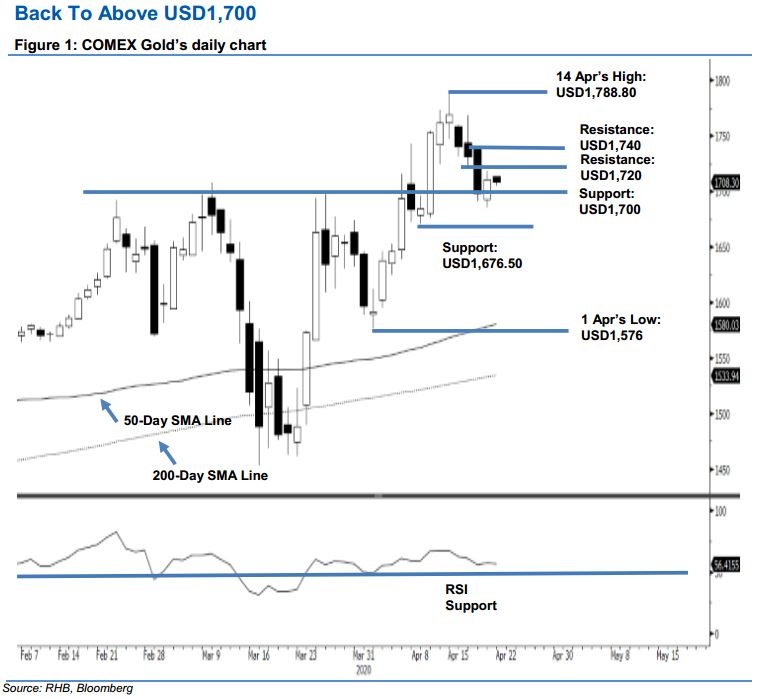

Maintain long positions while moving up the stop-loss. The COMEX Gold ended its 1-week retracement phase, as it staged a positive intraday price reversal to close at USD1,711.20 – this is back above the USD1,700 support level. The low was posted at USD1,685. With the commodity managing to settle above said support level – which we highlighted as an important resistance-turned-support threshold – the risk of it experiencing a deeper correction remains contained at this juncture. All in, the multi-month uptrend, which resumed after the 200-day SMA line was tested multiple times in March, is still likely to be extended. Hence, we are keeping our positive trading bias.

We advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,685 mark.

The immediate support level is maintained at the USD1,700 round figure. This is followed by USD1,676.50, or the low of 9 Apr. Moving up, the immediate resistance is pegged at USD1,720, which was derived from 17 Apr’s candle. This is followed by the USD1,740 threshold.

Source: RHB Securities Research - 21 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024