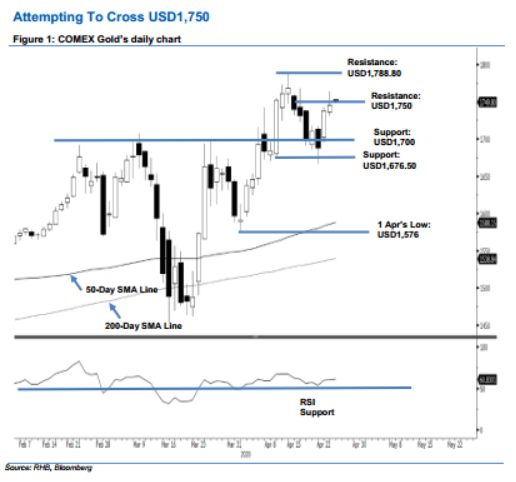

COMEX Gold - Attempting to Cross USD1,750

rhboskres

Publish date: Fri, 24 Apr 2020, 04:40 PM

Maintain long positions. The COMEX Gold attempted to breach above the USD1,750 resistance mark with an intraday high of USD1,764.20. This was before it gave back some of the gains to settle USD7.10 higher at USD1,745.40. We are not seeing the inability of the commodity to settle above the said immediate resistance as a price exhaustion signal – instead, it can be seen as a sign of profit taking. On a broader picture, the commodity has likely completed its slightly more than a week’s correction phase recently, with the retesting of the USD1,676.50 support mark – and is likely to extend its multi-month uptrend. The RSI reading is also still healthy. Maintain our positive trading bias.

We advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,685 mark.

The immediate support level is maintained at USD1,700, and is followed by USD1,676.50, or the low of 9 Apr. Conversely, the immediate resistance is set at USD1,750. This is followed by the USD1,788.80 threshold.

Source: RHB Securities Research - 24 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024