WTI Crude Futures - Sitting at Immediate Resistance

rhboskres

Publish date: Fri, 24 Apr 2020, 04:41 PM

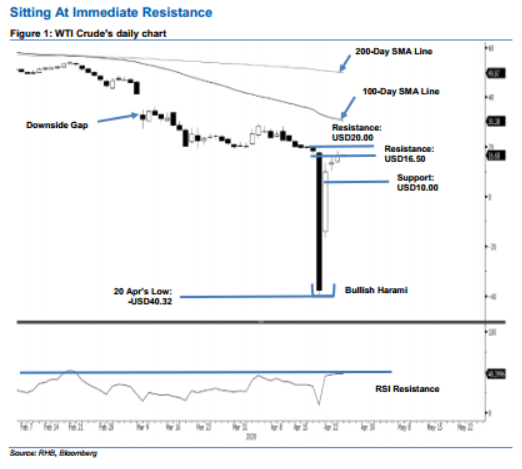

Maintain short positions, while tightening the trailing-stop further. The WTI Crude continued to stage a positive follow-up in the latest session, subsequent to 21 Apr’s “Bullish Harami” formation. The commodity reached a high of USD18.26, before closing at the immediate resistance of USD16.50, indicating a gain of USD2.72. Based on the recent three sessions’ price actions, the commodity is increasingly showing clearer price signals that a rebound is likely taking place. The rebound could gain further traction should the USD17.00 level be breached in the coming sessions. Pending this, we are keeping our negative trading bias.

As we are waiting for firmer evidence of a stronger rebound to emerge – warranted given the commodity’s high volatility – we continue to suggest that traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at above the USD17.00 mark.

The immediate support is revised to USD13.50 – derived from the latest candle, followed by USD10.00. On the other hand, resistance points are pegged at USD16.50 – near the high of 22 Apr – and followed by the USD20.00 threshold.

Source: RHB Securities Research - 24 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024