FKLI - Retracement Still Not Done Yet

rhboskres

Publish date: Mon, 27 Apr 2020, 11:22 AM

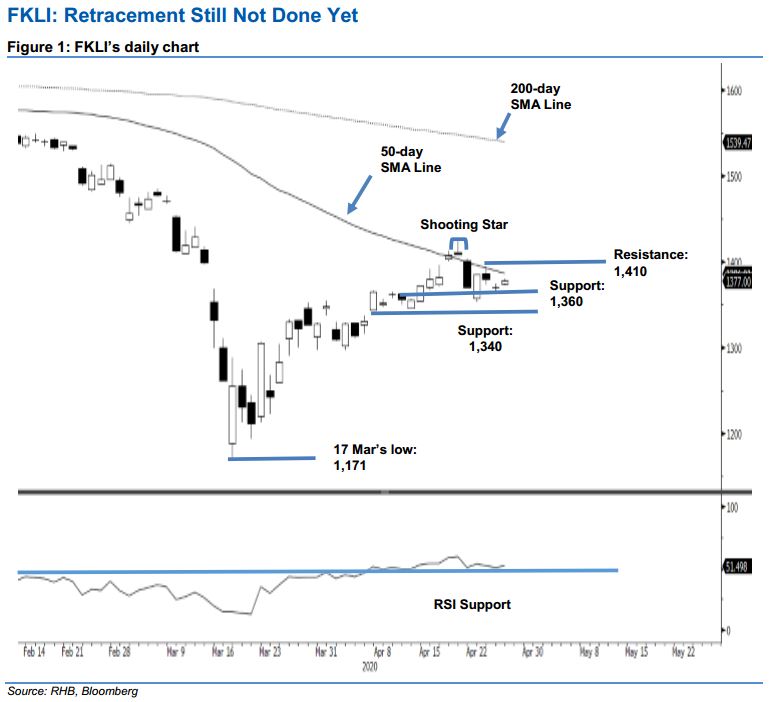

Maintain short positions, as the retracement leg is likely still in its early phase. Yesterday, the FKLI oscillated between a low and high of 1,372 pts and 1,379.5 pts, before closing 6.5 pts higher at 1,377 pts. However, the index is still capped by the 50-day SMA line. We believe it is still likely in the early stage of a retracement leg. This came after it completed its counter-trend rebound recently – where the high was marked by 20 Apr’s “Shooting Star” formation at 1,425.5 pts. Towards the downside, at the minimum, the index could retest the 1,340-pt support level. We maintain our negative trading bias.

As the next bigger move is still tilted southwards, we recommended that traders stay in short positions, initiated at 1,370 pts – the closing level of 21 Apr. To manage risks, a stop-loss can be placed above 1,410 pts.

The immediate support remains at 1,360 pts, followed by 1,340 pts. Moving up, the immediate resistance is at 1,395 pts – the price point of 21 Apr. This is followed by 1,410 pts, near the 50-day SMA line.

Source: RHB Securities Research - 27 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024