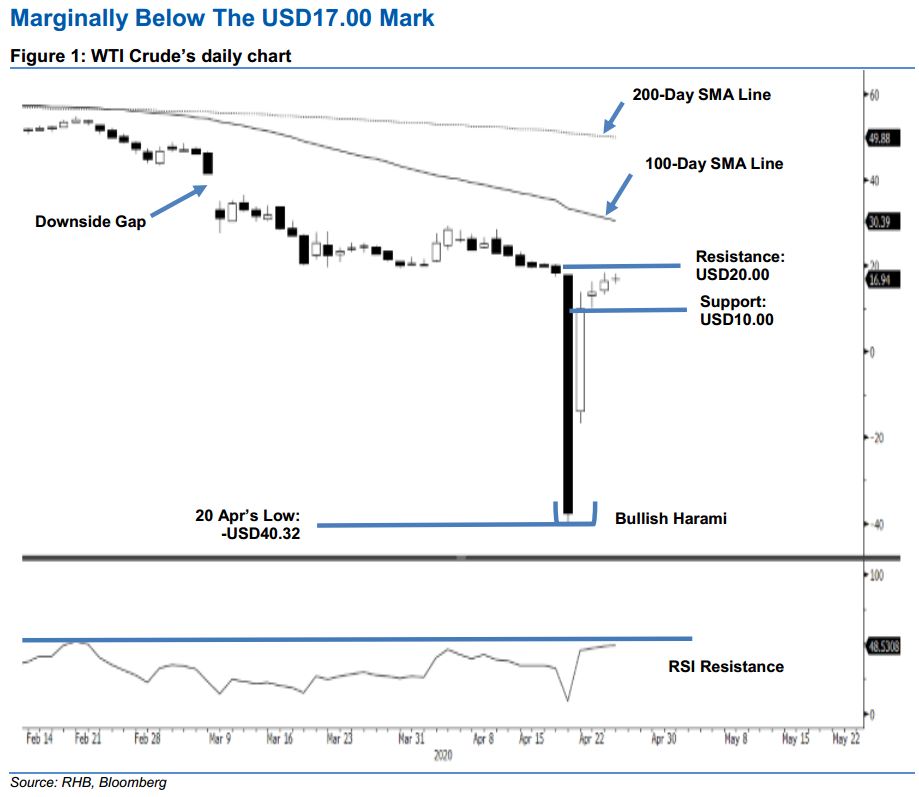

WTI Crude Futures - Marginally Below the USD17.00 Mark

rhboskres

Publish date: Mon, 27 Apr 2020, 11:29 AM

Maintain short positions. The WTI Crude crossed above the previous immediate resistance of USD16.50 in the latest session, closing at USD16.94 – indicating a gain of USD0.44. The positive session suggests the rebound that started from 21 Apr’s “Bullish Harami” formation is extending. Should the commodity manage to cross above the USD17.00 mark in the coming sessions, it would signal the rebound is gaining a stronger footing. The ongoing rebound is taking place to correct the recent sharp decline which saw the commodity’s RSI reading reached an oversold threshold. Maintain our negative trading bias.

We continue to suggest that traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed at above the USD17.00 mark.

The immediate support is maintained at USD13.50 – derived from 23 Apr’s candle, followed by USD10.00. Towards the upside, the immediate resistance point is now expected at USD18.26, the high of 23 Apr. This is followed by the USD20.00 threshold.

Source: RHB Securities Research - 27 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024