COMEX Gold - Pausing Around USD1,750

rhboskres

Publish date: Mon, 27 Apr 2020, 11:31 AM

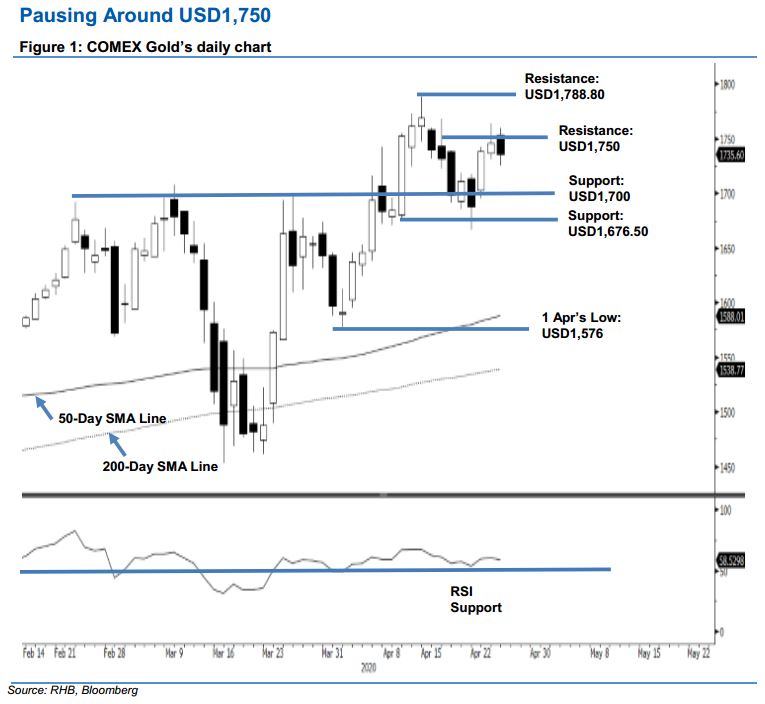

Bulls are consolidating around immediate resistance; maintain long positions. The COMEX Gold attempted to cross the USD1,750 immediate resistance level with a high of USD1,760.20, before ending at USD1,735.60. Looking at the precious metal’s latest two sessions’ price actions, we believe it is consolidating its recent gains around the said resistance mark. This was after it experienced a relatively sharp upward move after it tested the USD1,676.50 support level on 21 Apr. Once this minor consolidation phase is over, we believe the commodity is likely to extend its uptrend. Maintain our positive trading bias.

As the overall trend is still promising, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,685 mark.

The immediate support level is expected to emerge at USD1,700, and is followed by USD1,676.50, or the low of 9 Apr. On the other hand, the immediate resistance is set at USD1,750. This is followed by the USD1,788.80 threshold.

Source: RHB Securities Research - 27 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024