FCPO - No Deeper Rebound In Sight

rhboskres

Publish date: Mon, 27 Apr 2020, 11:38 AM

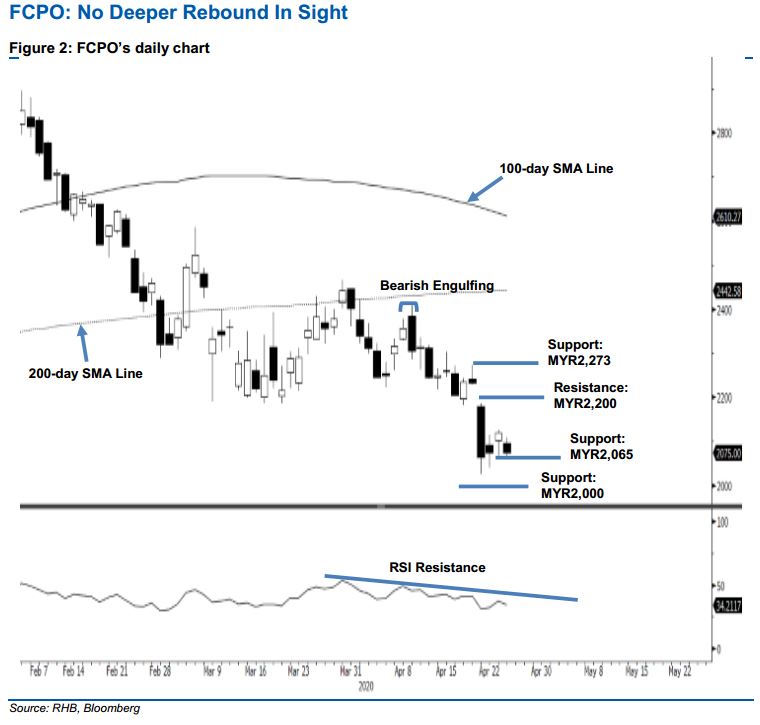

Maintain short positions as the rebound phase is still minor. The FCPO settled MYR44 lower at MYR2,075 – after ranging between MYR2,059 and MYR2,108. The weak session underpins our bias that the commodity’s price actions over the recent sessions only indicate that a relief rebound is taking place. This happens after the commodity underwent a relatively sharp decline after it breached below the 200-day SMA line in March. This negative bias is further supported by the 100-day SMA line which continued to curve downward, while the 200-day SMA line has plateaued and is likely to turn downwards soon. As such, we are maintaining our negative trading bias.

As the downtrend has yet to show signs of ending, we recommend that investors stick to short positions, We initiated these at MYR2,246, the close of 13 Apr. To manage risks, a stop-loss can now be placed at the breakeven mark.

The immediate support is set at MYR2,065, the low of 23 Apr. This is followed by MYR2,000. Conversely, the resistance points are pegged at MYR2,200, followed by MYR2,273 – the high of 20 Apr.

Source: RHB Securities Research - 27 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024