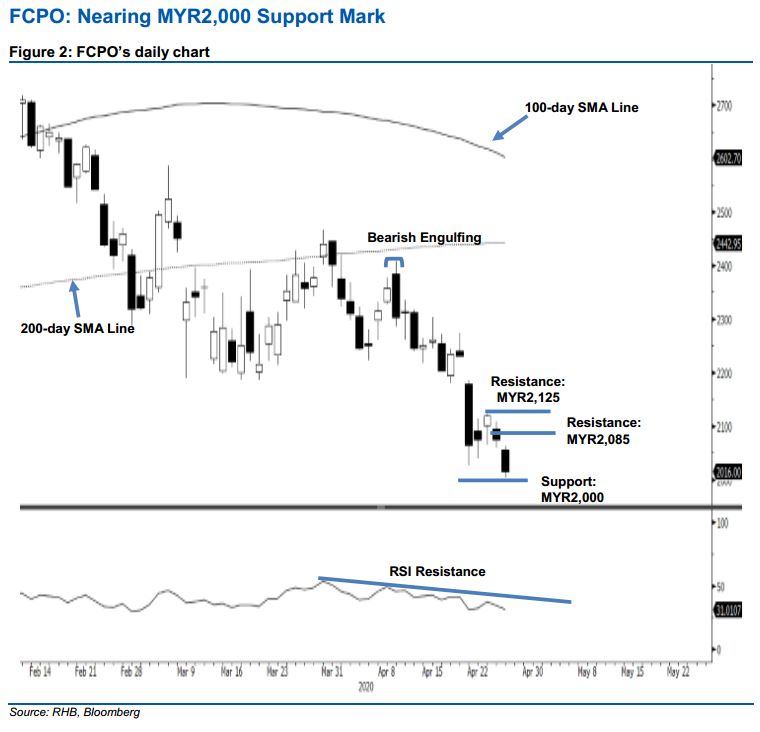

FCPO - Nearing MYR2,000 Support Mark

rhboskres

Publish date: Tue, 28 Apr 2020, 11:22 AM

Maintain short positions as the retracement is extending. The FCPO closed MYR59 weaker yesterday, at MYR2,016 – which fell below the previous immediate support of MYR2,065. The weak performance indicates that its downtrend – after breaking down from the 200-day SMA line in March – is being extended. This comes after a brief minor pause in the second half of last week. Based on the recent sessions’ technical picture, as long as the commodity is still capped by the MYR2,125 resistance, the overall downtrend remains intact. This is further supported by the RSI reading, which continues to slide lower. We maintain our negative trading bias.

As the bears have firm control of the market currently, we recommend that investors stick to short positions, We initiated these at MYR2,246, the close of 13 Apr. To manage risks, a stop-loss can now be placed above MYRY2,125

The immediate support is revised to MYR2,000, followed by MYR1,916 – the low of 10 July 2019. Moving up, immediate resistance is now pegged at MYR2,085 – derived from 24 Apr’s candle. This is followed by MYR2,125, the high of 23 Apr.

Source: RHB Securities Research - 28 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024