WTI Crude Futures - Rebound Stalled

rhboskres

Publish date: Tue, 28 Apr 2020, 11:40 AM

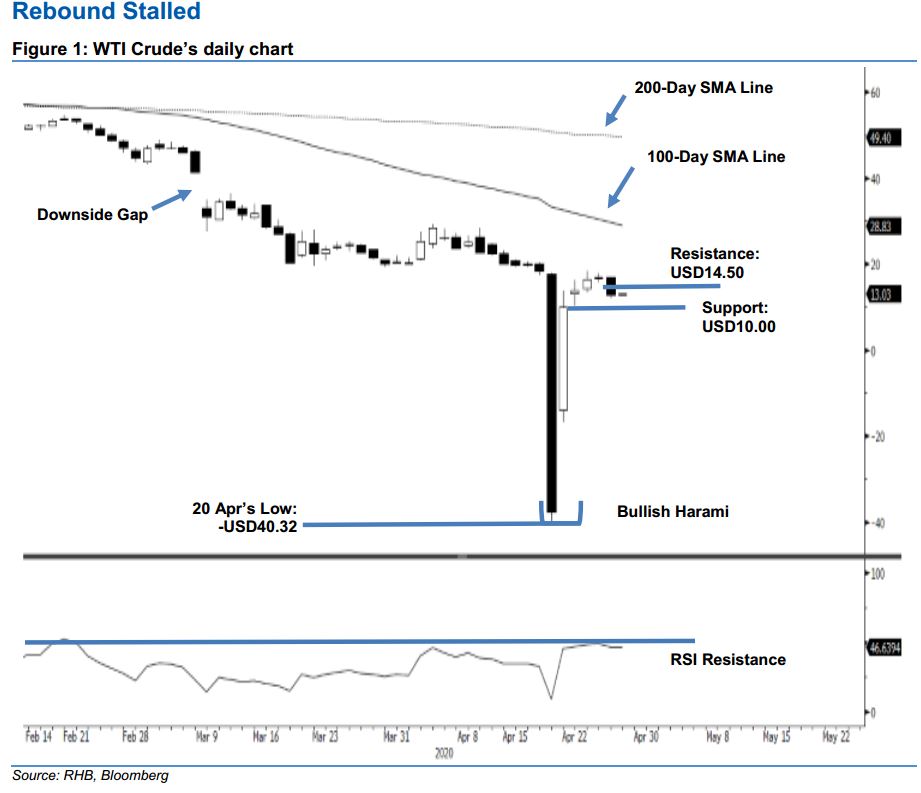

Maintain short positions, as the rebound has probably hit a wall. The WTI Crude experienced a wide trading range between USD11.88 and USD16.98 before closing USD4.16 weaker at USD12.78. This crossed below the previous USD16.50 immediate support. The session was the most volatile in the most recent three sessions. It also erased the previous two sessions’ gains and likely signalled that the recent rebound – subsequent from 21 Apr’s “Bullish Harami’ formation – has probably reached an interim top. The rebound kicked in to correct the commodity’s sharp retracement, which reached an oversold RSI reading. At this juncture, as long as prices are still capped below USD17.00, we maintain our negative trading bias.

We continue to suggest that traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed above the USD17.00 mark.

The immediate support is revised to USD10.00, and followed by the USD8.00 level. Moving up, the immediate resistance point is now expected at USD14.50, of the price point of the latest session. This is followed by the USD17.00 threshold.

Source: RHB Securities Research - 28 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024