Hang Seng Index Futures - Buying Momentum May Resume

rhboskres

Publish date: Tue, 28 Apr 2020, 11:41 AM

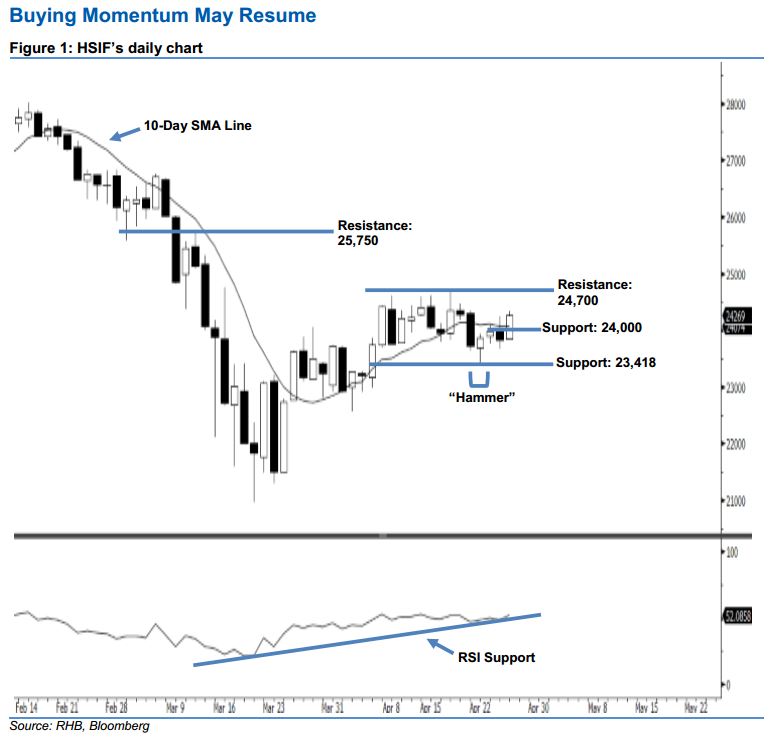

Stay long while setting a trailing-stop below the 23,418-pt support. The HSIF formed a white candle yesterday. It rose 435 pts to close at 24,269 pts, off the session’s low of 23,840 pts. From a technical viewpoint, investor sentiment remains positive. This is given that the index has recouped the previous session’s losses and climbed above the 10-day SMA line. Yesterday’s white candle may also further extend the rebound that started with 22 Apr’s “Hammer” pattern. Overall, we keep our positive view on the HSIF’s outlook.

As shown in the chart, the immediate support level is now seen at the 24,000-pt round figure. The crucial support is maintained at 23,418 pts, ie from the low of 22 Apr’s “Hammer” pattern. Towards the upside, we are eyeing the immediate resistance level at 24,700 pts, determined near the high of 17 Apr. Meanwhile, the next resistance is anticipated at 25,750 pts, which was near the high of 11 Mar.

Thus, we advise traders to maintain long positions, following our recommendation of initiating long above the 22,300-pt level on 25 Mar. At the same time, a trailing-stop can be set below the 23,418-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 28 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024