Hang Seng Index Futures - Upward Momentum Persistence

rhboskres

Publish date: Wed, 29 Apr 2020, 05:02 PM

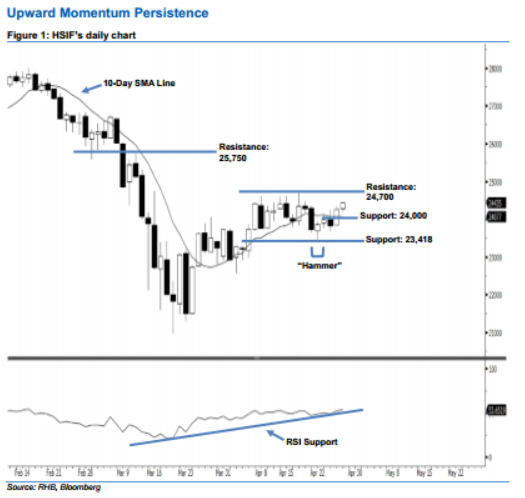

Stay long. The HSIF’s upside strength continued as expected, as a white candle was formed yesterday. This indicated persistent buying momentum. It gained 166 pts to settle at 24,435 pts. Technically, we think the positive trend is likely to continue, as the index posted a second consecutive white candle above the 10-day SMA line. This can be viewed as a continuation of the bulls extending the rebound from 22 Apr’s “Hammer” pattern. Overall, we expect the market to rise further if the immediate 24,700-pt resistance mentioned previously is taken out decisively in the coming sessions.

Presently, we are eyeing the support level at the 24,000-pt round figure. This is followed by 23,418 pts, which was the low of 22 Apr’s “Hammer” pattern. To the upside, the immediate resistance level is seen at 24,700 pts, ie near the high of 17 Apr. The next resistance will likely be at 25,750 pts, ie near 11 Mar’s high.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 22,300-pt level on 25 Mar. A trailing-stop can be set below the 23,418-pt mark to secure part of the gains.

Source: RHB Securities Research - 29 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024