WTI Crude Futures - Minor Bounce From Immediate Su

rhboskres

Publish date: Wed, 29 Apr 2020, 05:03 PM

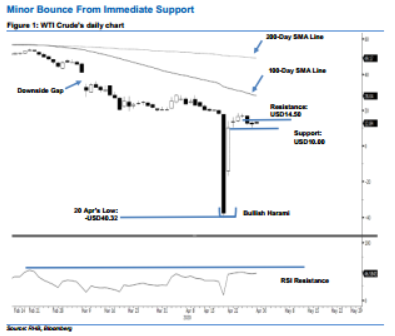

Maintain short positions. The WTI Crude managed to narrow its intraday losses as it settled USD0.44 lower at USD12.34. At one point, it came in near to test the USD10.00 support mark with a low of USD10.07. Despite the said strong intraday rebound, considering the commodity’s recent weeks’ high volatility, further positive price actions are still needed in the coming sessions to signal a firmer rebound is taking place. Based on the recent sessions’ price actions, an upside breach of the immediate resistance of USD14.50 would likely signal such a possibility. Pending this, we are keeping our negative trading bias.

Until a firmer rebound signal appears, we continue to suggest that traders stay in short positions. These were initiated at USD23.63, or the closing level of 7 Apr. To manage the risk, a stop-loss can be placed above the USD14.50 level.

The immediate support is maintained at USD10.00, followed by the USD8.00 level. Towards the upside, the immediate resistance is eyed at USD14.50, the price point of 27 Apr. This is followed by the USD17.00 threshold.

Source: RHB Securities Research - 29 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024